Today’s discussion: Why is there an annuity surrender charge and are they actually a bad thing?

Table of Contents

Understanding Annuity Surrender Schedules

- What is an Annuity Surrender Schedule?

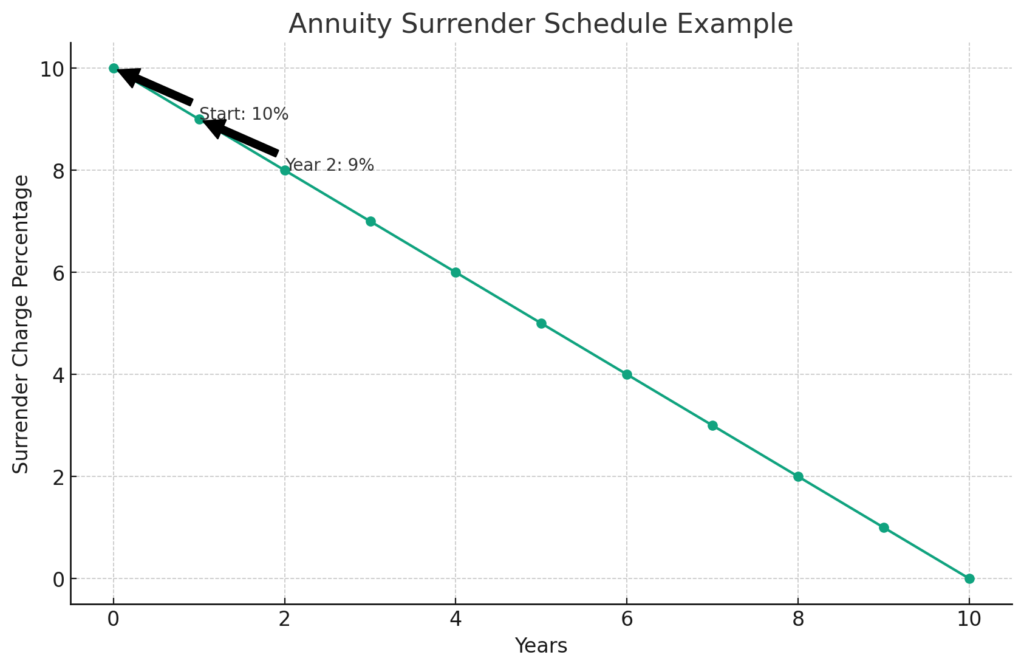

A surrender schedule is a decreasing percentage of charges incurred if you surrender the entire annuity before your term is over. Typically starting at 10 percent in the first 12 months, it decreases by 1% each year, minus your 10% Penalty Free Withdrawal. - Example Annuity Surrender Schedule Scenario

| Year of Surrender | Charge Percentage | Amount Received (on $100,000) |

| 1 (6 months) | 10% | $90,000 |

| 2 | 9% | $91,900 (with 10% withdrawal) |

The Logic Behind Annuity Surrender Charges

Annuities have surrender charges because the annuity company uses your money to purchase long-term investment-grade bonds. If they need to divest due to your early surrender, they pass the charge onto you. You’re funding the annuity for a predetermined benefit, for a predetermined amount of time, and the surrender charge ensures that the annuity company will hold up its end of the deal as long as you hold yours.

Comparing Annuities and Bank CDs

- Similarities: Both have early withdrawal penalties.

- Differences: Annuities offer more flexibility, allowing partial withdrawals without forfeiting the entire amount.

The Reasoning for Annuity Surrender Charges

- Company’s Perspective: Annuity companies purchase bonds with your premium to ensure principal protection. If they have to divest, they may have to take a loss on their bonds and they pass the charge onto you.

- Your Commitment: It’s about sticking to the agreed-upon term in exchange for the benefit received.

Minimum Guaranteed Surrender Value (MGSV)

Every annuity illustration includes the MGSV, detailing your worst-case scenario at any given point during your term. This provides a clear picture compared to other investments like stocks or bonds.

Avoiding Issues with Annuity Surrender Schedules

The short answer is this: work with a competent annuity advisor. Proper planning ensures you never need to pull more than the penalty-free withdrawal amount, avoiding unnecessary annuity surrender charges.

Exceptions to the Rule

Certain life events such as death, being diagnosed with a terminal illness, or being confined to a skilled nursing facility may allow for penalty-free withdrawal of the entire amount. Understanding these exceptions is crucial.

Conclusion: Are They Bad?

Annuity Surrender Charges and schedules themselves are not bad. They protect both parties involved. However, if an advisor has poorly allocated your assets, the surrender schedule can become a problem. The key is strategic planning and understanding the purpose of your money and how the annuity serves that purpose within the agreed-upon terms.

Thank you.

Have a FPIA, which was not explained thoroughly by my financial planner prior to purchase.

Hi George,

You’re very welcome! This why I take an education first approach, so I’m glad the information was helpful.

All the best,

Marty