- The Most Common Myth Around How Annuity Companies Make Money

- Debunking The Myth

- Understanding The Math Behind Annuities

- Investment Strategies of Annuity Companies

- How Annuity Companies Allocate Their Returns

- Key Takeaway: Structuring Returns Are How Annuity Companies Make Money

- Podcast Episode 4: How Annuity Companies Make Money

There are so many misrepresentations surrounding the question of how annuity companies make money, that I felt it was important to cover it in this week’s podcast.

The Most Common Myth Around How Annuity Companies Make Money

A pervasive myth in the annuity world suggests that annuity companies profit from the difference between the index returns and the annuitant’s credited rate (i.e., Cap Rate or Participation Rate). This myth posits that if an index you’re tracking returns 10%, and your annuity has a 50% participation rate, the annuity company is allegedly pocketing the remaining 5%. However, this understanding is fundamentally flawed.

Debunking The Myth

This is 100% not how annuities work. The misconception arises from a misunderstanding of the annuity’s structure and the financial model of the issuing company. Annuity companies don’t keep this ‘extra’ return; in fact, they already made their profit before the index ever completed its crediting cycle.

Understanding The Math Behind Annuities

Annuities aren’t magical; they’re mathematical. The calculations are sophisticated, and conducted by some of the smartest professionals in the financial world: actuaries. Think of them as the pediatric neurosurgeons who hate blood – they are exceptionally smart and adept at what they do.

Without getting too deep into the weeds, actuaries have to consider a range of variables, including market trends, interest rates, mortality rates, and economic forecasts. These calculations are critical in ensuring that the annuity company can meet its long-term obligations to its clients while remaining financially viable, while also providing opportunities to you, the client.

Investment Strategies of Annuity Companies

Annuity companies primarily allocate funds to investment-grade bonds. This strategy is pivotal because of the scale of funds they manage. Unlike individual investors, these companies handle large sums, allowing them to secure better returns and maintain longer investment periods.

For instance, consider a 5% return on bonds. While this might seem modest, the scale at which annuity companies operate turns this into significant earnings. This is due to the sheer volume of capital they invest.

The investment strategy of annuity companies is built on these principles – leveraging scale and focusing on stable, reliable returns from high-quality bonds. This approach underpins the financial stability of the annuities they offer.

How Annuity Companies Allocate Their Returns

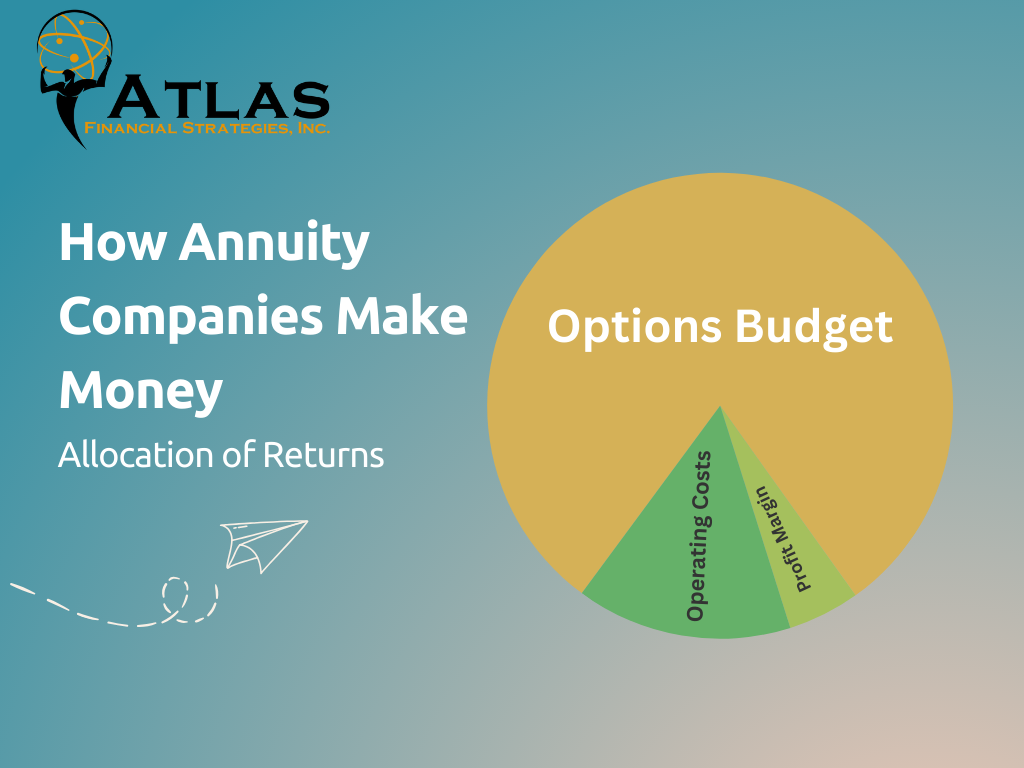

When it comes to understanding where the money goes in an annuity company, it’s fairly straightforward. This is a simplistic breakdown. The returns they earn are divided into three main areas:

- Operating Costs: First, a portion of returns are used to cover the day-to-day expenses of running the company. This includes paying employee salaries, taking care of office expenses, and handling commissions. These are essential for maintaining the operations and services they provide.

- Profit Margin: Next, they allocate a part of the returns as the company’s profit. This isn’t just about making money; it’s about ensuring the long-term stability and growth of the company. A healthy profit margin allows the annuity company to continue offering reliable services to clients.

- Options Budget: Lastly, the remaining part of the returns are put towards purchasing call options on market indexes. This is where you, as the client, directly benefit. These options give the ability to offer potential growth to your annuity based on market performance, without directly exposing your principal to market risks. Curious about how a call option works? Listen to Episode #4 where I go into great detail on how they work by giving you the opportunity for market-type growth without the risk

Key Takeaway: Structuring Returns Are How Annuity Companies Make Money

Remember: a lot of people are under the impression that annuity companies keep the difference between the index returns and the annuitant’s credited rate.

The truth is, annuity companies invest in investment-grade bonds, using their large-scale operations to garner better returns than individual investors. These returns are then allocated to cover operating costs, contribute to the company’s profit margin, and invest in call options on market indexes for the client’s benefit while simultaneously protecting your money from a market downturn.

This structure is designed to generate a profit for the annuity company and give their clients opportunities for either a fixed rate of growth or market-type growth without market-type risk. (SEC Report On Structuring Returns)

There’s a lot more detail that goes into exactly how this all happens, so for those of you with a curious mind(i.e., skeptical), I go into great detail in Episode #4 about how annuities work to bring the benefits that you have heard about, while also dispelling the mystery and all the negative press surrounding them.