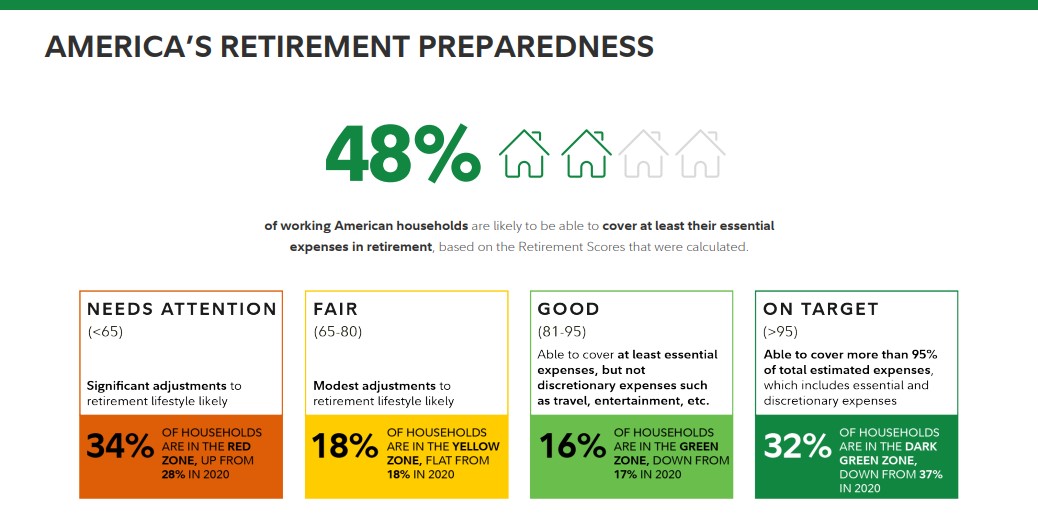

Are you prepared for retirement??? A recent study by Fidelity shows that only 32% of Americans are likely able to cover more than 95% of their total estimated expenses, which includes essentials and discretionary spending such as travel, entertainment, etc.

Only 16% will be able to cover just their normal living expenses without discretionary spending.

That means that less than half, 48%, of the population will be able to maintain their current lifestyle during retirement.

What about the other 52%? Well, they will have to make moderate to significant changes to their standard of living in retirement.

I’m going to let you in on a little secret. You ready?

It’s not your fault!

With the disappearance of defined benefit pensions, the vast majority of Americans were tossed into an arena that they were woefully unprepared for – the stock market.

The stock market in days gone by was for wealthy people to speculate and attempt to turn discretionary money into more money. But if it was lost, it did not affect their lifestyles.

With the introduction of the 401(k), which was originally designed to help wealthy executives defer taxes on bonuses, the average American was sold a bill of goods that this was a much better option than a pension because they could get those huge market gains and become millionaires!

It didn’t happen…

Some of you may be reading this and saying, “Hey, it worked for me. I have a million dollars in my retirement account.”

And if that’s you, that’s awesome! I would then encourage you to ask yourself, “What is the most efficient way to spend it?” Meaning, that retirement is not about assets. It’s about risk management and cash flow.

A huge pile of money doesn’t do any good if you don’t know how to decumulate.

If that’s not you, and you have a modest amount of retirement savings, I would encourage you to ask yourself, “How do I maximize my cash flow with the assurance I will never run out of money?”

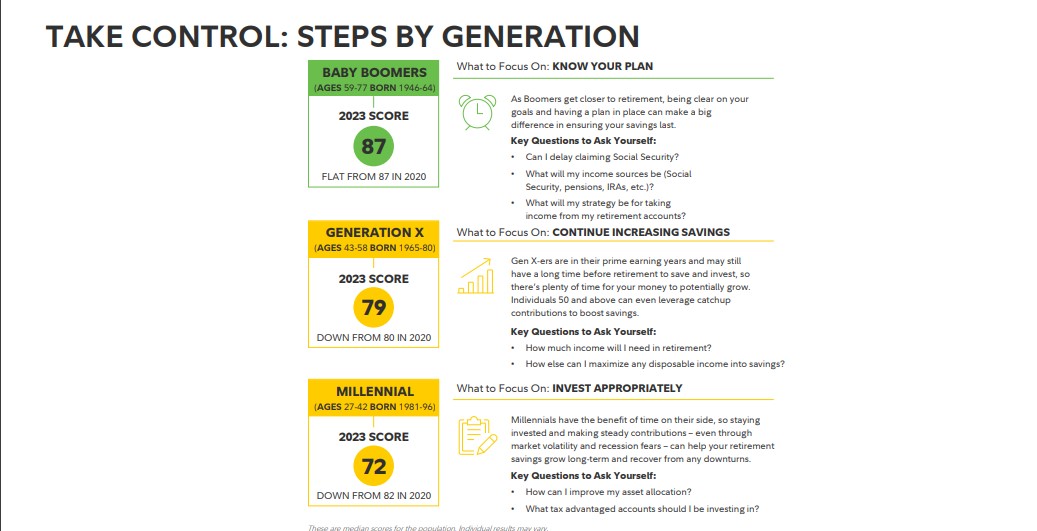

In this week’s ATLAS Annuity Newsletter, I am providing you with Fidelity’s key areas of focus for each generation to maximize their retirement savings (accumulation), and I will also provide some links to key videos I have made to teach the most effective way to get spendable cash flow (decumulation).

Annuities Improve Portfolio Outcomes (video)

Why Your Advisor Cannot Beat an Income Annuity (video)

Do Annuities Lock Up My Money? (video)

To learn the most effective way to use annuities in your personal retirement, click the “Schedule a Call” button in the top right corner to book your short phone call.

As always, I hope this finds you well!

All the best,

Marty