Rampant inflation. Soaring gas prices. Trillions of dollars printed by the Federal Reserve. COVID. China flying military planes over Taiwan. And now, Russia has invaded Ukraine.

What does all of this mean for your money?

Well, in short answer, I have no idea! But neither does anyone else. At best, everyone is guessing.

However, here’s what I do know. The market has been going up for 12 straight years, except for a single blip in 2020. What does history tell us about this kind of market growth?

Before I answer this question, I need to make one thing clear. I am not securities licensed, so this article is not to be taken as advice to either buy or sell any type of securities. This is for informational purposes only and to get you to ask yourself some very important questions.

I speak with a lot of people. A lot. And the vast majority of them are in the “Fragile Decade.” Meaning, the 5 years before their retirement and 5 years after their retirement. The reason this decade is so “fragile”, is that if you approach retirement, or you are in the early years of retirement, you are at the mercy of the “Sequence of Returns Risk.”

The Sequence of Returns Risk means that if you start to pull money out of your retirement funds for living expenses while the market is crashing, you increase your chances of running out of money before you ‘run out of life.’

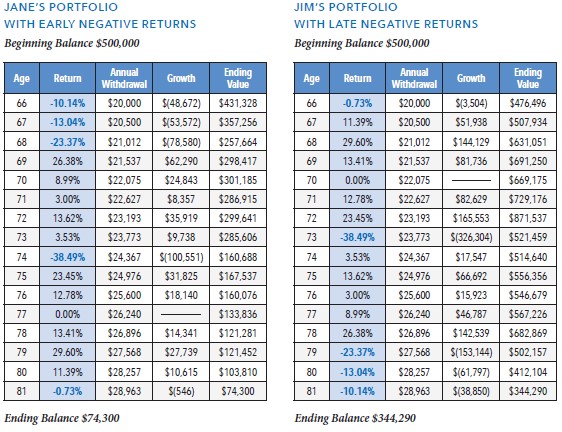

Here’s an example of what that looks like:

As you can see, Jane and Jim had the exact same amount of money saved for retirement, and they withdrew the exact same amount of money every year for living expenses. The only difference is the order, or the “sequence”, of the returns they received on their money. It’s the exact same returns, only they have been flipped to show the devastating effects that early losses can have on your retirement portfolio.

If you go into your retirement while the market is crashing, you are basically stealing the seed that has always planted the next harvest during your working years while you were accumulating retirement assets. And if you are within that “fragile decade”, most likely the time for planting is over because you must live off the current harvest for the rest of your life.

And as you can see above, a simple flip in the sequence of returns had a $270,000 difference for Jane and Jim as the end result!

For most of my clients, that is not chump change. It is the difference between being independent and having plenty of money, versus being dependent on the government and/or family to help you survive. No one wants that!

You may ask yourself, “Was Jim’s financial planner smarter than Jane’s?” I can assure, with almost certainty, they were not. What most people don’t want to admit is that a lot of this is based on luck. Wall Street is a casino. And just like in Las Vegas, that casino is designed to take your money. Sure, you’re going to win every once in a while. But how many stories have you heard of the gambler giving all of their winnings right back to the casino because they didn’t know when to quit?

I am sure there are good people in the financial planning business who are trying to do the right thing for their clients. But at the end of the day, they just don’t know what will happen next. There is no exact science to investing. If there were, we would all be wealthy. But, if Warren Buffet cannot time the market, then no one can.

I subscribe to many investment newsletters and every single day I get conflicting messages from different people: “Buy!” “Sell!” “Hold!” Who are we supposed to believe???

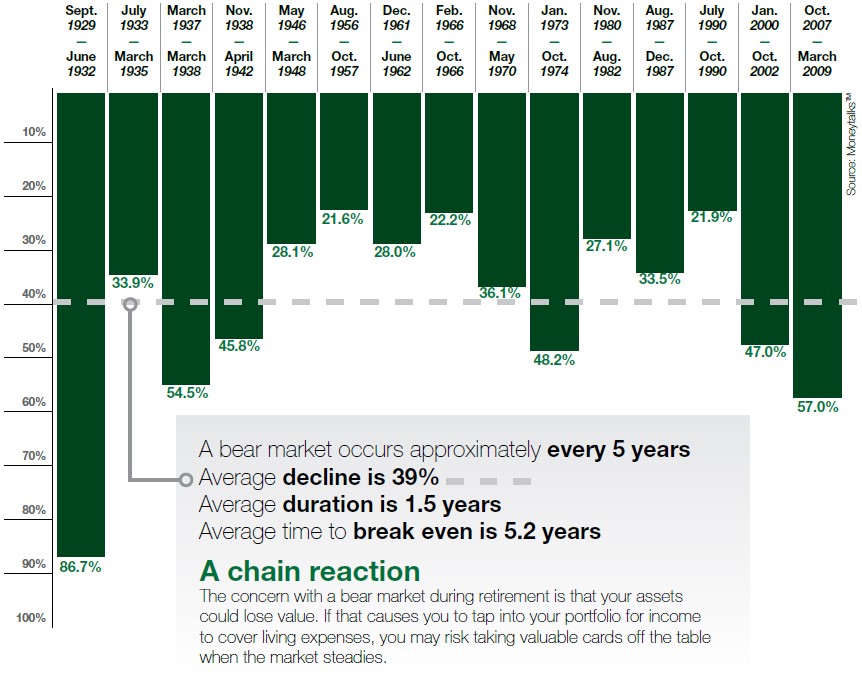

Why am I telling you all of this? Because, at this point in time, one of the most appropriate things we can do is to look at history as our guide. Let’s take a look at the following chart:

What we know, historically, is that there has been a market correction every 5 years on average since the crash of 1929. The average decline takes about 1 ½ years to hit the bottom with an average loss of 39%. Then, it takes a little over 5 years to break even. I’m not a nuclear scientist or anything, but the way I interpret that is, just when we’re getting back to even is about the time the next crash is starting.

The only difference for most of my clients in this scenario is that they are no longer adding money to the portfolio throughout the downturns. They are withdrawing it! Would anyone think you are crazy for believing that is a problem?

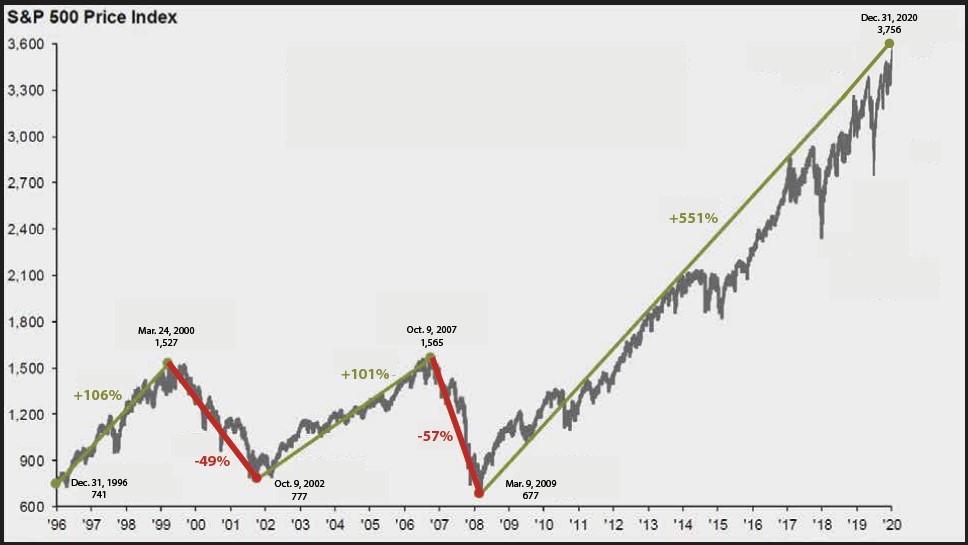

So, what will happen next? Let’s take a look at this next chart, and you can be the judge:

Again, I’m not splitting atoms over here. You don’t have to be a trained financial professional to see we are long overdue for a giant correction. The question is no longer, “What will happen next?”. That’s pretty obvious. The question now becomes, “What do we do about it?”.

As I mentioned above, I cannot advise you to sell your stock, bonds, or mutual funds. That is totally up to you. But what I can do is ask you some questions to put things in perspective. Take a moment to really consider these questions.

- How do you make an “unrealized gain” a “realized gain? Or, how do you take a “paper gain” and turn it into cash in your pocket?

- If the market does crash, do you want to, or can you, wait the 5 years to break even again?

- If the market does crash, how easy it will be to get through to your advisor to liquidate your assets to stop the bleeding?

- Are you still ahead of where you were 10 years ago? If yes, is it a ridiculous idea to take some of your winnings off the table and protect it?

- Do you think your advisor will waive their management fee if your account continues to decline?

- How would a 30%-50% loss of your retirement money affect your lifestyle?

I don’t mean for these to be “gotcha” questions. My intention is to get you to think about the money you have spent 30-50 years working for and sacrificing to accumulate.

Do I want you to transfer some of your money to an annuity? Yes, I do.

Am I biased because I am in the annuity business? Yes, I am.

But your advisor is also biased. They don’t want you to transfer to an annuity because they will take a pay cut. I guess my point is, this will affect your retirement way more than it will affect mine, or your current advisor’s.

What I really want, more than anything, is for you to really educate yourself on how annuities can change your retirement for the better. And the best way to do that is to watch my video series, “20% More Guaranteed Income in Retirement.” You can watch the first video at the bottom of this page, or just click the link above. Once you watch the series, don’t hesitate to reach out to me with any questions you may have. The best way to do that is to click the “Schedule A Call” button at the top of this page or call me directly at 636.926.6500.

I have one more question and then I will wish you, “all the best.”

Do you think you will ever regret protecting your money from being lost?

All the best,

Marty