Clark Howard is back at it with another video bashing annuities.

I don’t go around looking for these things, but I do spend a good amount of time on YouTube and this guy seems to have enough clout to get his videos shown to me every so often. And just like last time, he gets it absolutely wrong.

The podcast episode goes deeper into each of his gripes about annuities, but if you just want to read what “celebrity” financial guys are saying, I’ve listed each of his points here with a summary of the facts that prove he’s either wrong on purpose, or hasn’t bothered to do any research.

Clark’s Annuity Tax Criticism Doesn’t Tell the Whole Story

Clark claims annuities get poor tax treatment. That’s only true if you don’t understand how they work:

-

- IRA or 401(k): Distributions are taxed as regular income.

-

- Roth IRA: Tax-free if you follow Roth rules.

-

- Non-qualified money: Growth is taxed when withdrawn, not annually like mutual funds, or fixed products like CDs and bonds.

If you’re reinvesting dividends from mutual funds or stocks, you’re paying taxes every year, whether you use the money or not. Annuities defer those taxes, which can reduce your IRMAA and help you manage income in retirement.

Surrender Charges Aren’t a Gotcha

Annuity surrender charges exist because insurance companies buy long-term bonds with your money. If you back out early, they lose money and pass the cost on to you. It would be no different if you owned the bonds yourself and had to liquidate. But let’s clear something up:

-

- Some annuities have terms as short as 2 years

- Some annuities have terms as short as 2 years

-

- Most allow 10% free withdrawals per year

Surrender charges are common in financial products. CDs, bonds, B-share mutual funds—they all come with penalties for early withdrawals.

No One Works for Free—And Commissions Aren’t the Problem

Clark says annuities are only sold for commission, not based on client need. That’s a lazy take. Here’s the truth:

-

- Annuity commissions are paid by the insurance company—not taken from your money

- Annuity commissions are paid by the insurance company—not taken from your money

-

- All annuity applications go through a stringent suitability review

- All annuity applications go through a stringent suitability review

-

- Class A mutual funds charge fees that come directly from your account

And let’s not pretend advisors pushing mutual funds or stocks are doing it out of charity. The issue is the advisor you work with, not the product.

He’s Mixing Up Securities With Insurance

Clark keeps referencing 200-page contracts, which only apply to variable annuities. Those are securities, not insurance contracts. The annuities I use:

-

- They typically have 10-page disclosures

- They typically have 10-page disclosures

-

- Don’t invest in the stock market

- Don’t invest in the stock market

-

- Offer principal protection

- Offer principal protection

If your advisor can’t explain your contract, that’s a problem with them—not the product.

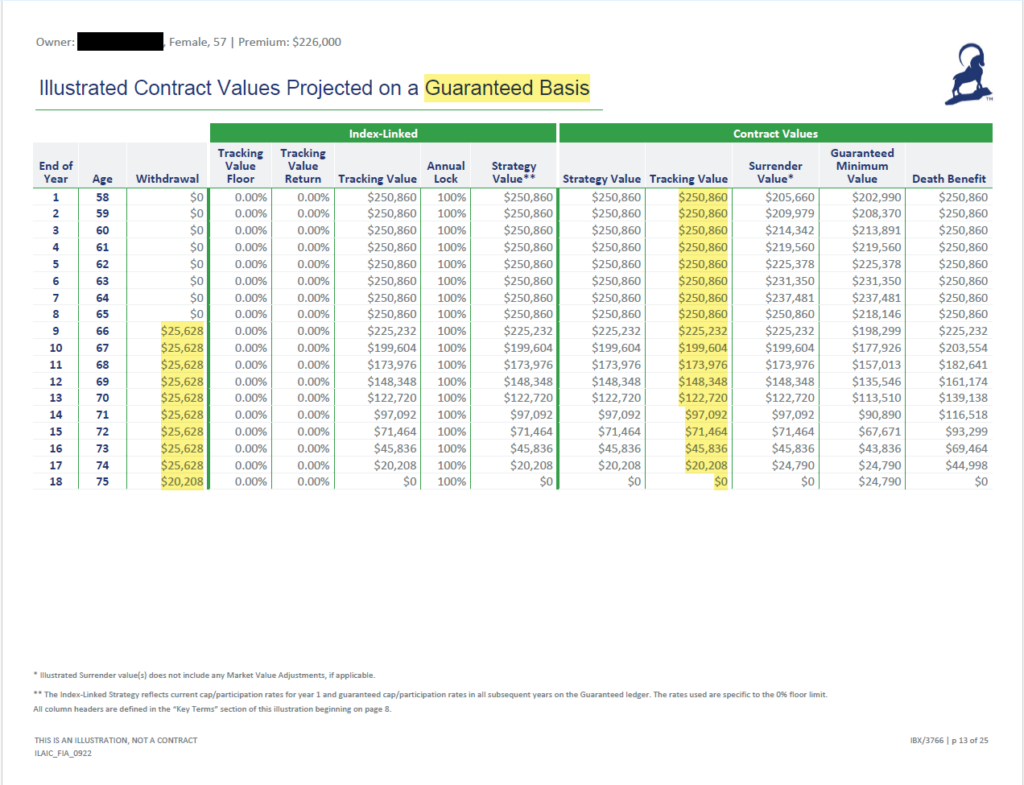

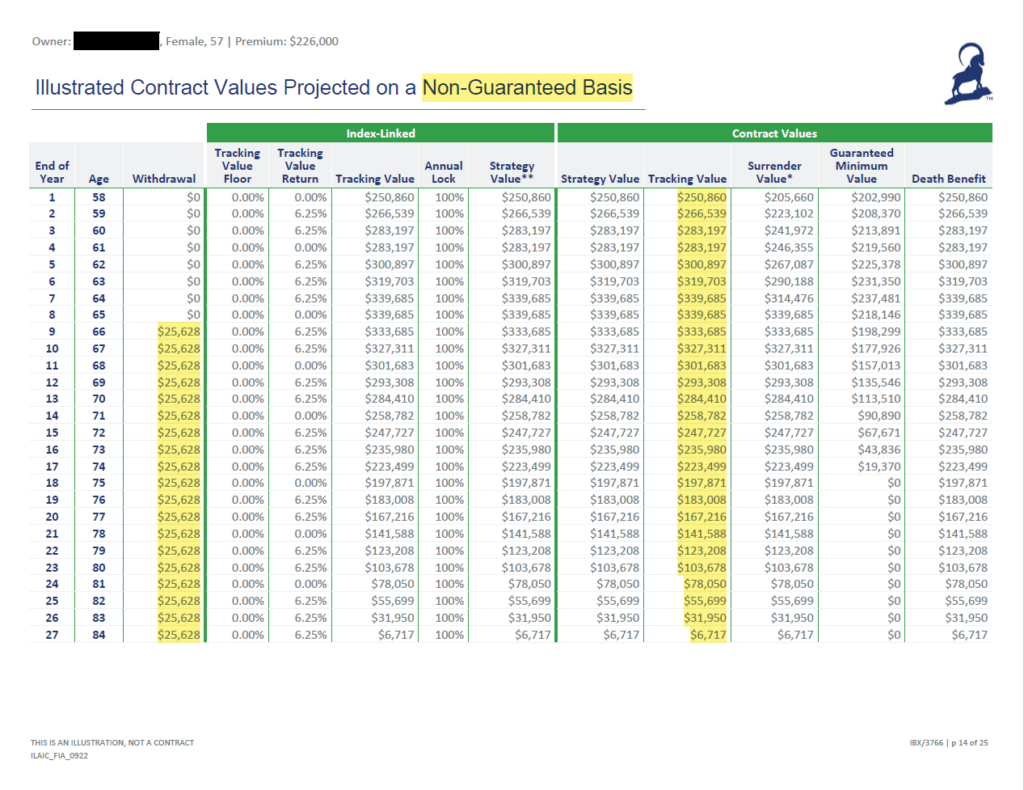

Are These Illustrations Really Misleading?

Clark claims annuity illustrations are misleading and hide the fact that they show hypothetical returns. Here’s what mine looks like:

| Page Title | What It Shows |

| Guaranteed Basis | Minimum contract values with 0% floor |

| Non-Guaranteed Basis | Growth potential based on index history |

I tell every client to expect real results somewhere between the two. But to say we’re hiding this information? It’s right there in bold at the top of the page.

Yes, Some Agents Don’t Know What They’re Doing—But That’s Not the Product’s Fault

He’s right about one thing: some agents don’t understand what they’re selling. That’s true in every industry. But again, he’s blaming the product for the agent’s lack of training. That’s backwards.

He Proves My Point on Uncertainty

Clark says agents pitch annuities during “uncertain times.” Exactly. That’s the whole point.

-

- Markets crash

-

- Politics and economies shift

-

- Life throws curveballs

Annuities are safe money. They give you a stable base to rely on when everything else is shaky.

Yes, Indexed Annuities Have Limits—That’s the Trade-Off

One of Clark’s longest—and frankly, most smug—complaints is that Indexed Annuities protect your principal but only give you part of the market’s upside. But think about it: how else would you expect to get zero downside risk without giving up some of the upside?

That’s the trade-off. You’re giving up unlimited growth in exchange for never losing money.

But even with that trade-off, indexed annuities give you options for how your growth is calculated:

The insurance company makes this possible by using your money to buy call options—not by investing directly in the market. That’s how they protect your principal while still offering growth potential.

If you don’t understand call options or how annuity companies use them to grow your money, I highly recommend listening to Episode #4 of The ATLAS Annuity Podcast

What About Dividends and Long Holding Periods?

Clark complains that annuities don’t pay dividends. That’s true—because they don’t invest in stocks directly. But that’s why you don’t lose money when the market crashes.

As for being “locked in for 15 years”?

-

- Many FIAs are 5 years

-

- MYGAs come in as short as 1-year terms

Compare that to someone who bought the S&P 500 in 2000 and had to wait 14 years just to break even.

He Finally Talks About the Good Ones—Sort Of

At the end, Clark mentions SPIAs and DIAs as decent options, but then goes on to proclaim that no one out there offers them because they don’t pay as much commission.. Funny—those are the very products I talk about every day. I use software that compares payouts across every top-rated company. Clark never mentions that.

A Quick Note on Longevity Annuities

Clark also brings up QLACs. I’ve never used one, but they can make sense if you want to:

-

- Remove up to $200K of IRA money from RMDs

-

- Delay income until age 85 or younger

But it’s a gamble—you only win if you live long enough.

The Fiduciary Red Herring

He ends with a rant about fiduciaries. Here’s my take:

-

- Fiduciary is often just a marketing word

-

- I go through more compliance and training than most advisors

-

- Bernie Madoff was a fiduciary, and we all know how that ended

What really matters is character, not a title.

▶️ Check out Episode 12: What is a Fiduciary

This is Not About Clark—It’s About Getting the Right Info

Just to be clear—I don’t have anything against Clark Howard personally. I’m sure he’s helped a lot of people with their finances. But when it comes to annuities, he’s missing the mark.

This stuff matters. Annuities can be a powerful part of your retirement plan, but only if you understand how they actually work. That’s why I respond to videos like this. Not to argue—but to make sure you have the full picture before making decisions with your life savings.

If you want to see how annuities can help you spend 20% more in retirement—without worrying about market risk, running out of income, or locking up your money forever…

▶️ Watch the full video series

And if you’re wondering how it could apply to your situation, just click the button in the top corner to schedule a short call with me.

All The Best,

Marty Becker

Podcast Episode #78: Dismantling Another Clark Howard Annuities Rant

Download Episode #78: Dismantling Another Clark Howard Annuities Rant on Apple Podcast