In today’s episode, we’re going to be looking at a case study that I’ve recently done, and we’ll just refer to this as the ATLAS Annuity Strategy versus “Dinner Seminar Annuities.”

What happens often on this website, is people will reach out to me to get a recommendation or a second opinion on an annuity that they were pitched at a dinner seminar.

I don’t have anything against dinner seminars or the advisors who put them on. What I do have a problem with is that you have a room full of people with very different scenarios and financial situations, and they’re all being pitched the same product.

And there’s no way that it’s appropriate for all of them.

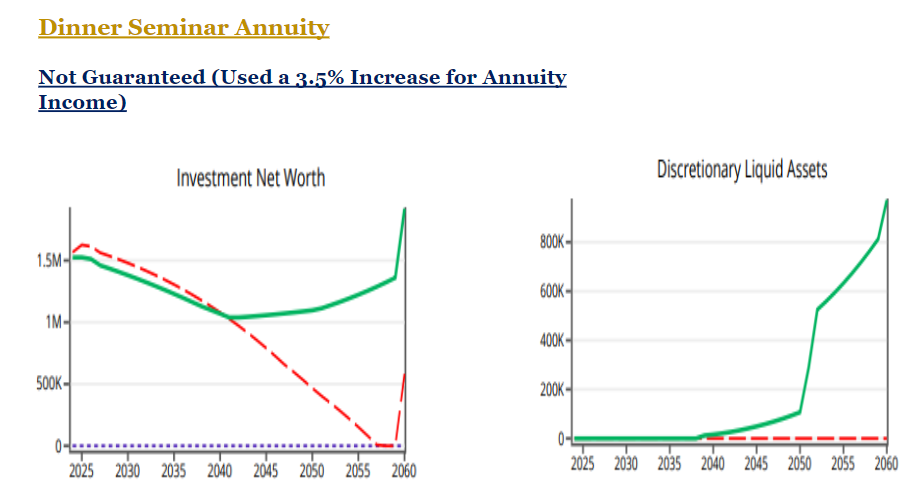

Adjusting B.S. Dinner Seminar Annuity Projections

The couple that we’re going to look at who reached out to me are 63 and 65 years old. The husband’s going to work for about another three years. The wife is already retired, collecting a pension. At his retirement, they’ll have about $6,200 a month between the social security and her pension.

They’ve got about 1. 5 million in assets between IRAs and Roths and non-qualified money, and they’re looking for about $8,800 spendable per month. After income taxes and Medicare costs, they’re looking at anywhere from $9,500 to $10,000 per month that they’ll actually need coming through the door.

Now, this particular client was pitched a popular annuity at a dinner seminar in the amount of $450,000 and they were buying into the hype with some really unrealistic growth projections on it.

So I had to be the bad guy and bring them back down to reality and say, “With annuities, especially this particular annuity, we need to be super conservative because we’re counting on this for income. So we don’t want unrealistic projections. So we will stick with a projection of 3.5% growth just to be on the safe side.

The major issue here is that they really don’t have any discretionary liquid assets with the dinner seminar annuity until around 78 years old. I don’t know about you, but most people I know in their late 70s and 80s have slowed down a bit and they don’t need large sums of money for discretionary spending.

Most people want to spend early in their retirement when they have the energy and the will to get out of the house and live life. Not that they can’t do it later in life, but most people are slowing down at that age.

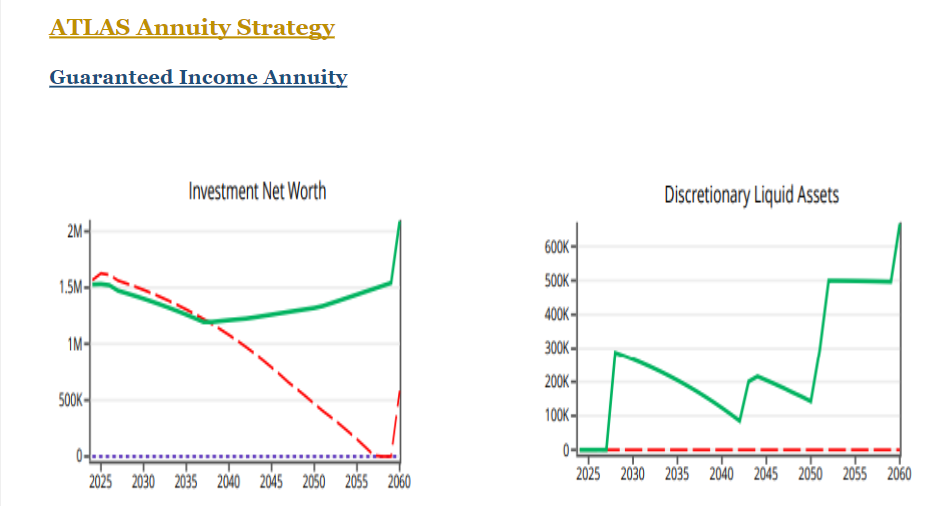

Comparing The ATLAS Annuity Strategy

Now let’s look at the ATLAS Annuity Strategy, which is just a plain Jane fixed index annuity with a guaranteed income rider, which means it’s very predictable. We know exactly what we’re going to get out of it. Their net worth ended up about the same in the long-term from when they first retired.

But look at what happened to their discretionary liquid assets. The day this couple walks out the door for retirement, they have almost $300,000 in discretionary liquid assets that they can tap into if they want to do some luxury things above and beyond their income needs.

So if they want to pull $100,000 out to buy a ski boat, they can!

Not only that, the discretionary liquid assets never dropped below $100,000 for the rest of their lives. So they always have free liquidity.

In the podcast episode, I stress-test both of these annuity solutions using positive and negative sequences of return examples to show what would happen in the best and worst-case scenarios.

Both times, using a fixed indexed annuity that was custom tailored for this particular client’s situation outperforms the dinner seminar annuities in discretionary liquid asses AND net worth.

I highly recommend watching this episode on YouTube so you can see the graphic details of each option. If you have questions about a particular annuity that you’ve been pitched, make sure to schedule an appointment on my calendar and I’ll help you analyze the projections versus reality.

Podcast Episode 24: Beware of Dinner Seminar Annuities

Download episode 24 “Beware of Dinner Seminar Annuities” on Apple Podcast