I’m fortunate enough to have a subscription to a financial newsletter by Paul Dietrich, the Chief Investment Strategist of B. Riley Wealth, provided to me through an affiliate. I can tell you right now that Paul does not like annuities, but at least he is honest about what is happening in the market, and what will happen in the near future.

In this week’s newsletter, I’m going to provide some excerpts from his latest newsletter, and then you can decide what is right for you. The main thing that caught my eye was that the S&P could drop to 3,000-3,300 before going back up again. At the time of this writing, it’s at 4,150.

Whatever you do, don’t listen to the paid pundits on the financial channels. And be wary of the advisor that is telling you to “ride it out because the market always comes back.”

This newsletter is in no way to be taken as advice to buy or sell any securities. It is for informational purposes only.

But doesn’t the “ride it out until the market comes back” advice just sound, I don’t know…stupid!

To be perfectly clear, Paul Dietrich does not like annuities, and nowhere in the article does the word annuity even appear. So, this is not a scare tactic to make a pitch for annuities. This is a warning that, just maybe, it isn’t a terrible idea to hit the “pause button” while your money sits somewhere that is immune to market volatility. That could be a money market, a bank CD, or yes, an annuity.

Here are some excerpts from Paul’s Newsletter:

- Many Wall Street analysts mention in their reports that they have never seen so many severe risks to both the economy and the stock market.

- S. foreclosure filings have increased for 23 consecutive months. They were up 22% in the first quarter compared to a year ago, and repossessions hit their highest level in three years. (Note: I do not believe this is a pending warning of the housing market, but to show that people have either lost their jobs or are overleveraged. We are still around 5 million homes short in inventory for the current demand.)

- A drop in transportation stocks foreshadows a weakening economy. Transportation is considered a leading economic indicator.

- The credit crunch and tighter borrowing standards could lower U.S. GDP by a half-percentage point over the next year, according to the IMF.

- According to the IMF, high inflation and interest rates will hobble U.S. and global economies for several years.

- The IMF says the global economy faces the weakest growth prospects in more than 30 years.

- Retail sales have fallen in four of the past five months as consumers pull back on spending. The U.S. economy shows signs of cooling as retail sales decline more than expected.

- Costco falls on the lowest U.S. sales growth in almost three years.

- UBS analyst, Michael Lasser, predicts that retailers could close more than 50,000 stores by the end of 2027. He wrote that store closures would accelerate available credit and greater e-commerce competition. Smaller retailers will feel the most pressure.

- Commercial real estate prices could plunge as much as 40% from their peak, according to Morgan Stanley Wealth Management’s CIO. He expects a worse crash than the 2008 financial crisis due to a string of factors, including tighter lending standards following the banking crisis, which makes it harder for investors to refinance a significant amount of looming debt. (Commercial Real Estate, not Residential)

- Commercial real estate mortgage loans dropped 56% in the first quarter compared to a year ago, and loans fell 42% in the fourth quarter.

- Most economists expect spending to slow this year and unemployment to rise due to persistently high inflation and interest rates. Higher borrowing costs make it more expensive to take out a loan, buy a house or a car, or use a credit card.

And here are the big ones I wanted to point out:

- Morgan Stanley’s Chief U.S. Equities Strategist, Mike Wilson, reiterated his call that the S&P 500 had yet to see the bottom.

- Wilson said that “forward earnings-per-share growth – or how investors expect earnings to behave over the coming year – has dipped negative.” In the past, that has meant that stocks almost always decline.

- Wilson said, “This has only previously happened four times over the past 23 years. In each prior instance [2001, 2008, 2015, 2020], equities have faced significant price downside associated with the shift from positive to negative earnings growth.”

- Wilson said he sees the S&P 500 bottoming between 3,000 – 3,300 before it starts to go up again.

Whoa! Okay, take a breath. Don’t slit your wrist just yet. There is a solution. And the solution is not to be taken for a ride…again. If you are at retirement age, I bet you remember the past 23 years very well. It’s the same crap over and over again. Maybe there wasn’t a whole lot you could do about it back then because your money was locked up in a 401(k), but this time can be different.

If you haven’t already, then you need to seriously consider protecting yourself and your financial future. This market turmoil isn’t even close to being over. And the more you lose, the more you must make back just to break even.

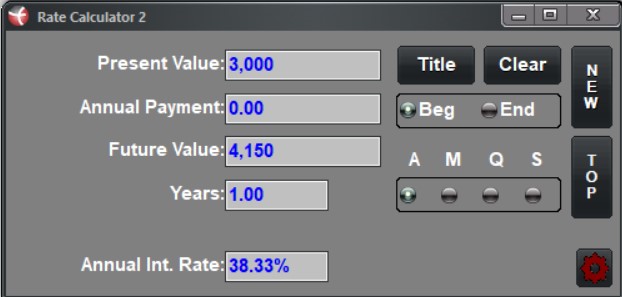

As of this writing, the S&P is at 4,150. If it drops to 3,000, that is a 27.7% loss.

But it doesn’t take a 27.7% increase to break even. It takes over a 38% gain just to break even!

Let’s put that in real dollars:

For every $100,000 you have, a 27.7% loss equals $27,700.

$100,000 – $27,700 = $72,300

If the market only rebounds the percentage that is lost, you fall way short of breaking even:

$72,300 + 27.7% ($20,027) = $92,327

This is why it’s so hard to ever recover from market losses when you’re already retired. Because you are no longer contributing like you were in your working years, AND you may be pulling money out of the account for living expenses or RMDs. You’re literally stealing the seed that has always been planted to grow the next harvest. And this is exactly how people run out of money in retirement.

But as I said above, there is a solution. Just choose not to participate in the loss anymore. That doesn’t mean you should never have money in the stock market, but if the guys who analyze this stuff every day for a living are telling you point-blank that it’s going down, then maybe we should listen.

Again, this is not advice to buy or sell any security, but doesn’t it just make sense to hit the pause button?

And you can do that with a money market, a bank CD, or an annuity.

The first 2 things you can get at your local bank. Now, I told you at the beginning of this newsletter this wouldn’t be a “pitch” for annuities, but if you want to consider an alternative that will give you protection & growth, and/ or guaranteed income that is immune to market volatility, there are specific strategies that work best for specific people.

If you haven’t watched my ATLAS Annuity Strategy video series already, then I highly encourage you to take some downtime this weekend and dig in! I give several different case studies, and most likely one of them will ring true for you. You can watch them by clicking here.

And please don’t hesitate to reach out and get your questions answered by booking a short phone call by clicking the “Schedule a Call” button in the top right corner of this screen.

I hope this newsletter finds you well this holiday weekend and that you get some quality time with friends and family!

All the best,

Marty