The DALBAR Quantitative Analysis of Investor Behavior (QAIB) has been released for 2022. Every year, DALBAR releases a comprehensive study that shows the psychology behind investors’ behavior and why they make the decisions they make.

I have never really had any interest in that part of the study because I understand the psychology of my clients. They want safety and guarantees. Period.

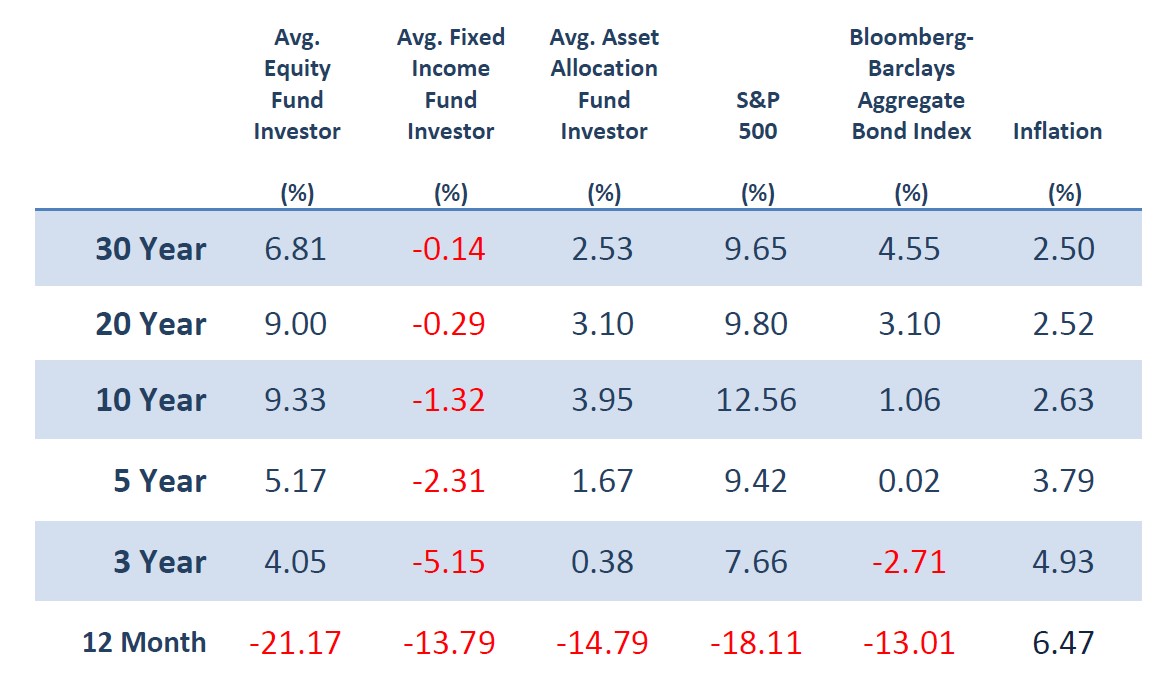

However, I order a copy of this every year for one reason. They list the past 30-year average returns of several different portfolio models:

- Equity Fund Investors (Mutual Funds that have a fee to manage them)

- Fixed Income Investors (Bonds, T-bills, and the like)

- Asset Allocation Fund Investors (A 60/40 type portfolio, or a mix of equities and fixed instruments)

- S&P 500 (The returns of the actual index)

- Bloomberg Barclay’s Bond Index (An index full of bonds)

- Inflation

What I think you will find shocking is the portfolio type that the vast number of people are in today, and have been for a long time, the Asset Allocation Fund, has only had a 2.53% return over the past 30 years!

But to add insult to injury, when you compare that to the average inflation rate of 2.50% over the past 30 years, what is the real, spendable, return these investors received?

Yep, you got it. 0.03%!

All that time of watching your money go up and down. All the worry and restless nights knowing that your account lost money and praying that it rebounds. All the mental energy expended planning your income with your advisor so you don’t run out of money. All of that for…0.03%???

I have run thousands of scenarios using historical returns of different portfolio models, and the same results keep happening. Using an Income Annuity and having a foundation to ensure all your living expenses are covered, and having the rest of your money in the S&P 500, literally smokes the outcome of every other scenario listed above.

What if you have enough income already with pensions, Social Security, and other investments? Splitting the money between a Fixed Indexed Annuity and the S&P 500 works just as well. When you take the losses out of the equation with a portion of your money using the FIA, you come out way ahead. Especially if you are in a situation where you are taking RMDs.

In this week’s newsletter, I am providing you with a free copy of DALBAR’s QAIB Report so you can read it for yourself. I know I harp on the same thing almost every week, but I like to provide 3rd party information to back up my claims.

To download your free copy, click this link… DALBAR 2023 QAIB.

I hope this finds you well and please don’t hesitate to reach out with any questions by clicking the “Schedule a Call” button in the top right corner of the screen.

All the best,

Marty