Indexed Universal Life is a subject that comes up from time to time with clients. They were pitched or saw a video on the magic of an Indexed Universal Life (IUL) policy. When I am approached with questions about IULs, I let everyone know that I am licensed to sell them and that I could make a ton of money doing so, but I refuse to do it. You’ll have to get it from someone else if you really want it.

What could be so bad??? When you hear of features and benefits such as market gains without market losses, tax-free income, unlimited contributions, and a death benefit to boot – it sounds great on the surface! But as with anything, the devil is in the details. And there are a lot of details in these insurance products that I think even the people selling them don’t understand.

Recent lawsuits against insurance companies have prompted the National Association of Insurance Commissioners (NAIC) to revise Regulation AG 49, with AG 49-A which will limit the illustrative growth in these types of policies.

I personally have the same beef with some annuity illustrations that show ridiculous returns based on past performance that can in no way be guaranteed to ever happen again. However, the difference with annuities is at least your principal is protected from ever decreasing.

That is not the case with IULs. I have heard horror stories of people who have paid into these policies for years, decades even, and because of all the hidden devils, they either had to walk away from all of the money they contributed over the years, or come up with tens of thousands, if not hundreds of thousands, of dollars just to keep the death benefit.

You see why I don’t want anything to do with Indexed Universal Life???

So how, and why, would a scenario like that happen?

IULs are completely market driven. This means the market must perform, with no down years, to work in the way they are illustrated.

When you look at an IUL illustration, they will show you maybe a 7% average return. However, they are illustrating that 7% is an actual return. Meaning, that if the policy is going to perform the way it is presented, then it must have a 7% return every single year.

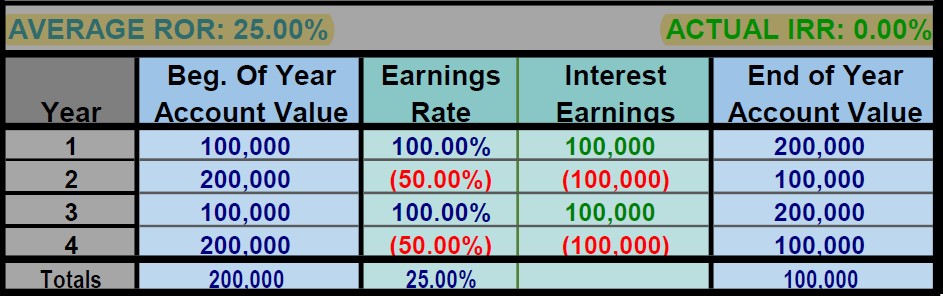

I’ll give you an example between average returns and actual returns, or what I call Wall St Math:

You see if I double your money, then lose half, and repeat that cycle again, your average return is 25%! But, your actual return is 0%! Nada! Nothing!

This is a huge problem in IULs because when you have a year with a zero percent return, you technically didn’t lose money from a market downturn, but you are still charged the cost of insurance. Now, the next year not only do have to get the original 7% that is illustrated, but you have to make up for that additional 7% that you didn’t get the previous year, plus the cost of insurance.

If there is 0% return 3 years in a row, like would have happened in 2000, 2001, and 2002, now you have to make up 21% PLUS 3 years for the cost of insurance. How are you supposed to do that with something that has a 12% cap on it?

It doesn’t take too many of these years with a 0% return for this whole thing to go completely off the rails.

Here is the other devil in the details. IULs have a YRT, or Yearly Renewable Term. This means every year that you get older, the cost of your insurance goes up! Every single year. Not a big deal when you’re in your 30’s and 40’s. But as you get older and you have some of those years with zero percent returns, it turns into a real problem.

The fact that people are living longer than ever before, an Indexed Universal Life Policy could implode and have dire financial consequences.

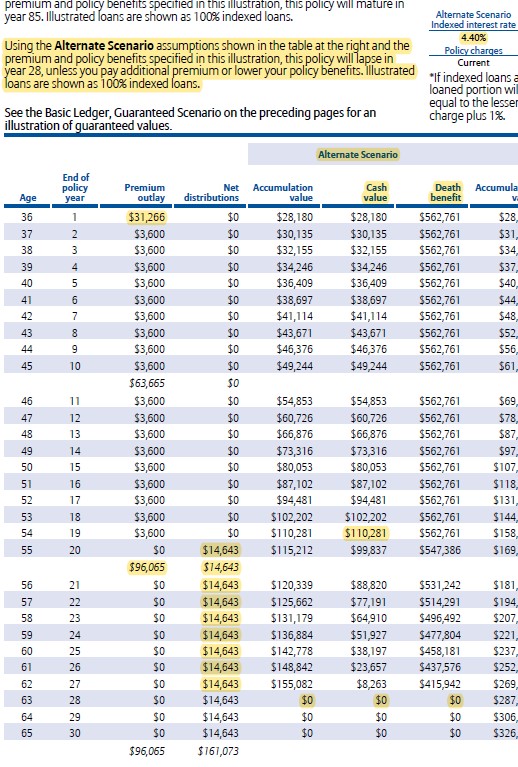

Let’s take a look at a real IUL policy that a client had me analyze. This is for a 36-year-old female, so she would have a relatively low cost of insurance early in the policy. She front-loaded the policy with just over $36,000 and then has a planned premium of $3,600 per year until the age of 55 when she will stop making premium payments, reverse the policy, and then get a tax-free income of just over $14,000 per year.

In this illustration, they give her 2 scenarios – an average 4.4% return and a 7% return scenario.

The 7% scenario is so ridiculous we’re not even going to look at it for time’s sake. However, a 4.4% average return seems pretty reasonable, right? Remember, this does not illustrate an average return. This shows what would happen with an actual return, meaning that she would earn 4.4% every single year with no 0% years, which most likely is never going to happen.

But, even if it does happen, she has put a total of $96,065, and the cash value that she will start pulling her income from at age 55 is $110,281.

What has been her actual return over the past 19 years???

0.82%!!!

So, she literally has to earn 4.4% every single year, for 19 years, just to get a 0.82% return on her money. How does that make sense at all?

Plus, keep in mind that as she is pulling the income out, the policy must still return at least 4.4% every single year with no 0% years. So, in reality, that income could disappear even faster.

And her best-case scenario is 8 years of income from something that she contributed to for 19 years.

After that, nothing. No cash value, no income, no death benefit. Nothing!

So, you ask, what is the real long-term risk of an IUL?

It’s this – The growth does not keep up with the cost of insurance, all or most of the cash value gets eaten up, you get little to no income, and then the only way to keep the death benefit is to pay more money into it. A lot more!

This is why I will not sell you an IUL.

“So, Mr. Smart Guy. What would you recommend this young lady do?”, you may be asking.

How about this?

She takes the same amount of money that she was planning to contribute into the IUL and let’s say gets a 3% return on it over the next 19 years. She could easily do that with CDs even when the rates were not great. At the age of 55, she would end up with $156,726.

She could then take that money and transfer it into an income annuity and receive $10,572 per year (at the time of this writing), guaranteed for the rest of her life, no matter how long she lives.

“But she would have gotten over $14,000 with the IUL”, you may be saying.

Again, maybe. If everything went perfectly. And even then she only would have gotten it for 8 years.

I’ll take the other scenario with a little less money, but on a guaranteed basis, every day of the week and twice on Sunday.

This example is just one of many that we can use the ATLAS Annuity Strategy for. If you find yourself in a situation where you don’t know what to do, or you are confused about your options, then I would highly recommend watching my video series, “20% More Spendable Income In Retirement”, then take advantage and book a time for a short visit with me by clicking the “Schedule a Call” button so we can see if the ATLAS Annuity Strategy is right for you!

All the best,

Marty

Omg, thank you for this! I knew this was too good to be true. I just didn’t have the financial knowledge to explain why. And thank you for actually having an opinion (and giving easy to follow examples) about it versus just giving pros and cons of IULs.

Hi Erika,

You’re very welcome! I’m glad this helped because, unfortunately, the IULs are one of the most over-hyped products available and I honestly believe most of the advisors selling them do not fully understand the severe pit falls. If you are looking for advice on a better system for using life insurance as a future retirement benefit, you can always book a time to talk at http://www.atlasannuity.com

All the best,

Marty