If you’ve recently inherited an annuity, there’s a good chance you’re feeling confused, stressed, or even a little pressured to make a decision quickly.

You might be asking questions like:

-

- “Do I have to take the money out right away?”

-

- “How much will I owe in taxes?”

-

- “Can I move this or am I stuck with it?”

Today I want to slow things down. I want to walk you through what really matters when you inherit an annuity. This needs to happen before you sign the paperwork and trigger a tax bill you cannot undo.

Why Inherited Annuities Are So Confusing

Non-qualified inherited annuities are confusing for one simple reason. They don’t follow the same rules as something like an inherited IRA. And they don’t work like regular non-qualified (meaning after tax dollar) investment accounts either.

On top of that, the insurance company gives you a stack of forms and a deadline to turn those forms in. But they really don’t explain what they mean.

Here’s the key thing most people don’t realize: Once you make certain choices with an inherited annuity, they’re irreversible. Once you get that money, you can’t go back and change the way you got that money.

The Two Big Questions You Need to Ask

Question 1: Who Did You Inherit It From?

The rules change depending on who you inherited the annuity from.

If you inherited from a spouse: You usually have the most flexibility. In most cases, you can even just continue the annuity as if it were your own.

If you inherited from a parent, sibling, or someone else: The rules are a lot tighter. You generally must begin taking distributions within the first year of the original owner’s passing. From their date of death, you have one year to take a distribution.

This distinction alone can mean the difference between smart tax planning and unnecessary taxes.

Question 2: What Type of Money Was in the Annuity?

There are two types:

Qualified money: This is tax-deferred money, like an IRA. All the money has been tax deferred.

Non-qualified money: This is after-tax money. The original owner already paid taxes on the money they put into the annuity.

Important disclaimer: I am not a tax professional. This is not tax advice. This is general information only for educational purposes. Always consult with a tax professional for any specific or personal questions about any type of inheritance that you’ve received.

How Do These Taxes Actually Work?

This is where the most mistakes happen.

Qualified (Tax-Deferred) Inherited Annuities

With a qualified tax-deferred inherited annuity, you are taxed on the entire amount as it comes out to you.

Key point for people under 59½: If you’re under 59½ and you need access to the money from a deceased spouse’s IRA, you may want to highly consider keeping that in their name or as a non-spousal inherited IRA. That way, you can access the money without the 10% IRS penalty.

This really does pertain to a spouse. If your spouse dies and you’re under 59½, and you move the IRA into your name, you now own the IRA. That means you cannot access that money until you’re 59½. So if you’re in that situation, go talk with a tax professional.

For non-spousal qualified inheritance: You have 10 years to withdraw all the money. You have to get it out within 10 years, with only a few exceptions.

Unless you’re an “eligible designated beneficiary.” This means:

-

- You are within 10 years of the age of the person who left it to you (like a sibling close in age)

-

- You’re a minor child of the descendant

-

- You’re disabled or chronically ill

If you are an eligible designated beneficiary, then you can take the withdrawals based on a single life expectancy table. You can take smaller chunks out over a longer period of time. This hopefully minimizes the amount of taxes you pay.

Non-Qualified, Non-Spousal Inherited Annuities

This is where it starts to get a little confusing for people. We’re going to talk specifically about a non-qualified (taxes were already paid on the original amount) and non-spousal (you got it from someone who wasn’t your spouse) inherited annuity.

Keep in mind, you’re only going to be taxed on the gains, not the original principal that was put in there.

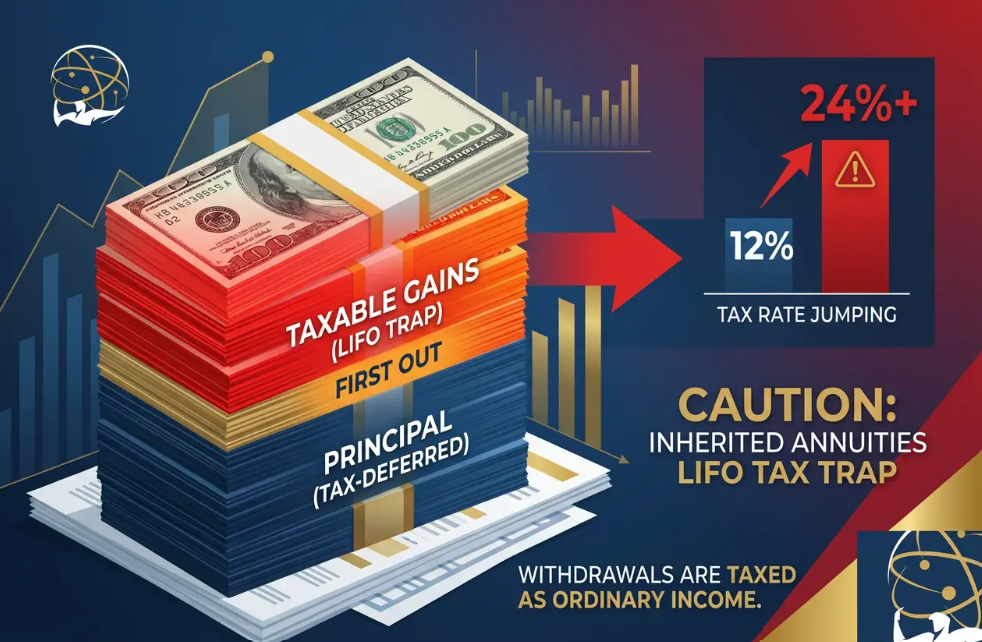

But this is critical: The distributions are going to be taxed by something called LIFO, for short. That means Last In, First Out.

That means all of the taxable earnings (all of the gains inside that annuity) are going to come out before the tax-free principal that was originally put into the annuity.

Translation: The first dollars you take out of a non-qualified, non-spousal inherited annuity are often going to be the most heavily taxed.

I’ve seen people take large lump sums because it just feels simple. What can happen is you accidentally push yourself into a much higher tax bracket.

For example: If you’re in a 12% tax bracket right now and you’re right on the cusp of 24%, you can very easily double the amount of taxes that you’re going to have to pay if you take the lump sum.

A slower, more intentional distribution strategy can often reduce the lifetime taxes dramatically.

Your Three Distribution Options

You basically have three options.

Option 1: Lump Sum Distribution

This is where you take all the money at once.

Why people choose this:

-

- It feels simple

-

- They want immediate access to the cash

-

- They don’t want to deal with ongoing paperwork

The hidden downside: The taxable gain is going to be recognized all in one year. Depending on how much that annuity has grown, it could be a lot. This often pushes people into a much higher tax bracket. You permanently lose the ability to spread those taxes over time.

This can make sense for:

-

- People in a lower income year (maybe you just retired and don’t have earned income)

-

- The annuity wasn’t that old and doesn’t have much gain in it

-

- You need the money for something time-sensitive

This is usually bad for:

-

- High-income earners

-

- Anyone close to the next tax bracket

-

- People who don’t actually need the money right away

Option 2: The Five-Year Distribution Rule

You must fully empty the annuity by the end of the fifth year. But you control the timing of when you take it out.

You can take a big chunk in the first year, throughout the middle, or evenly distribute it. That’s up to you.

Why people choose this:

-

- A little more flexible than the lump sum

-

- Gives you the ability to spread that income over five years

-

- Easier than the lifetime calculations

The big advantage: You can better manage your tax brackets. You decide whether to take the money evenly or unevenly. It’s useful for some income smoothing.

The downside:

-

- It’s still a relatively small window to get that money out

-

- Larger balances can still cause you to get bumped into a higher tax bracket

-

- Poor planning by bunching income into the final year

This normally works well for:

-

- People who are retiring soon or who have just retired

-

- Someone expecting a lower income over the next few years

-

- Beneficiaries who want control but not the longer commitment of the lifetime payout

Option 3: Single Life Expectancy (Lifetime Payouts)

This is a required distribution that is calculated using the IRS single life expectancy table (you can Google and easily find this). This starts within the first year of inheritance.

Why people choose this:

-

- The distributions are smaller (but required every year)

-

- Gives you the maximum tax deferral on the gains inside the annuity

-

- Helps with long-term planning flexibility

The biggest benefit:

-

- Often results in the lowest annual taxable income

-

- Taxes are spread over decades, not years

-

- You retain the flexibility to take more if you need it

Remember, with annuities, after the first year, you can take up to 10%. Once you’re out of the original term (whether it’s five, seven, or ten years), then all of the money’s freed up. You can take it however you want. But if you want to spread it out, you would do it by the single life expectancy table.

The trade-off:

-

- More paperwork and monitoring (you’ll receive a tax statement every year)

-

- The rules must be followed precisely

-

- Not all annuity contracts allow for this option

There’s a limited number of companies that will accept a non-qualified, non-spousal inherited annuity.

This option is normally best for:

-

- People with higher incomes

-

- People who don’t need the income

-

- If you’re focused on tax efficiency and legacy (spreading the money out, making it last as long as possible, and maybe even passing it on to the next person)

Comparison Table: Your Three Options

| Option | Timeline | Tax Impact | Best For | Flexibility |

|---|---|---|---|---|

| Lump Sum | Immediate | Highest – all taxes in one year | Low-income year, small gains, urgent need | None after withdrawal |

| 5-Year Rule | Up to 5 years | Moderate – spread over 5 years | Recent retirees, moderate balances | You control the amount |

| Lifetime Payouts | Life expectancy | Lowest – spread over decades | High earners, long-term planning | Can take more if needed |

Common Mistakes People Make

Here are a few of the common mistakes people make with inherited annuities:

Mistake #1: Taking the lump sum without understanding the tax consequences.

Mistake #2: Letting the insurance company default you into a payout option.

Mistake #3: Assuming all annuities are the same. They most definitely are not. The annuity that the original owner had may not be very good. Now you have the opportunity to move it to something much better. But you have to know what’s available in the marketplace.

Mistake #4: Rushing because you think you have to make this decision immediately. They gave you all this paperwork. They’re pressuring you to get it back in. At the end of the day, they want it off their books, or they want to know what they’re going to have to do with it.

You have 12 months to take the first distribution. How you take that distribution will set the precedent for how you have to take the rest of the distributions.

In most cases, you do have time. But only if you don’t sign the wrong form too quickly.

The Smartest First Step

The smartest first step after inheriting an annuity is not choosing a payout. It’s getting clarity.

That means understanding:

-

- The type of annuity that you have inherited

-

- The taxable versus non-taxable portion

-

- Your distribution options

-

- How that fits into a broader financial and tax picture

Get advice from a tax professional.

But then (which is really important): Find out which annuity companies will actually accept the annuity you have inherited. And out of those, which one will give you the best rates to hopefully continue that annuity growing in value. That’s where a guy like me would come in.

Once you understand those pieces, the decision usually becomes much clearer. And far less stressful. Having someone to guide you through this gauntlet of all this paperwork you’re going to be getting makes a huge difference.

Need Help With Your Inherited Annuity?

If you’ve inherited an annuity and you’re not sure which distribution option makes sense for your situation, don’t let the insurance company pressure you into a decision you can’t undo.

I’d be happy to walk you through your specific scenario and help you create a tax-smart strategy before that 12-month window closes.

Book a call and let’s get your questions answered.

Thanks for reading. I’m wishing you all the best in your financial education.

—Marty Becker

Atlas Financial Strategies

Podcast Episode 101: Inherited Annuities: Stop Before You Sign That Paperwork

Download Episode 101: Inherited Annuities: Stop Before You Sign That Paperwork on Apple Podcast