A December 2nd article in The New York Times written by Jeff Sommer, had an astounding admission. Out of 2,132 Mutual Funds, not a single one beat the overall returns of low-cost index or bond funds. Not a single one!

Here’s a quote from Jeff Sommer:

“It’s very hard to beat the stock or bond markets with any regularity.

Each year, some investors manage to do it, of course, but can they do it consistently? A new study of actively managed mutual funds by S&P Dow Jones Indices asked that question and came up with a startling result.

It found that not a single mutual fund — not one — managed to beat its benchmark in either the U.S. stock or bond markets regularly and convincingly over the last five years. These results are even worse than those of 2014 and 2015, when I last examined this subject closely.

These findings support practical advice that has been the academic consensus for decades. Forget about trying to beat the odds and outsmarting everybody else. Instead, use low-cost stock and bond index funds that mirror the overall market, and keep them for decades. Don’t bother with fads or fancy market timing.”

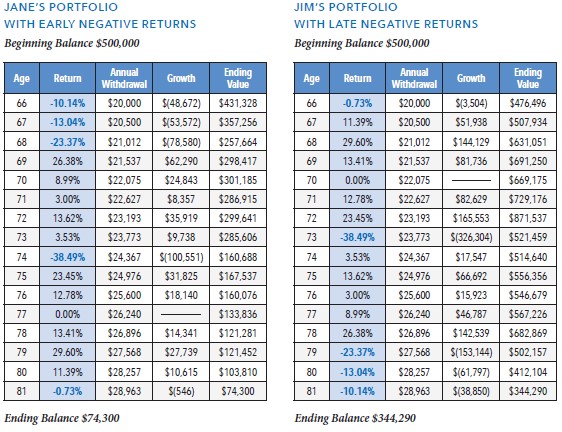

Now, from an “academic consensus” this may make sense. But if you have been reading my material for any length of time, you know about the “Sequence of Returns Risk.” If you experience early losses in your retirement, you greatly increase your chances of running out of money before you run out of life.

Here’s an example:

Some people/advisors spread the money all over the place, or “diversify”, and they get lackluster results. Or, as Jeff Sommer has written:

“Picking stocks and bonds on your own — or getting a professional to do it — may seem a better way to go. But before you take that route, examine the latest evidence. It shows that as bad as index funds have been, actively managed funds have generally been worse.

For 20 years, S&P Dow Jones Indices has been providing “scorecards” that compare the performance of active mutual fund managers with a series of benchmarks, or indexes, that capture the broad stock and bond markets, or discrete pieces of them.

In a nutshell, these report cards have never been particularly good for actively managed funds. The studies have found that most actively managed mutual funds do worse than their benchmark index, both over the long run and in the vast majority of calendar years, in the United States and elsewhere around the globe.”

In a previous article, I mentioned a gentleman I met at my gym named, Mike. Mike used to work for one of the largest brokerage firms in the country, if not the world and told me a story of how he confronted his manager in an open meeting about the Mutual Funds they were being advised to push to their clients. Mike was concerned those weren’t the best options available to recommend, so why were they recommending them? Long story short, Mike’s manager said that those funds are what the company made the most money from and to never ask a question like that again in an open forum. Mike resigned a couple of weeks later…

Article continued:

“Still, every year, some actively managed funds do outperform the indexes. If you own one that does, you may not care about all the others that fail to do so.

But then the issue is, will this outperformance persist? Another way of putting the question is this: Are these funds beating the market because they are lucky or because some investors are more skillful than others?”

Cough cough…CASINO!

“There is no absolutely correct, quantifiable answer to these questions. Some investors are undoubtedly more knowledgeable than others and make better decisions. But are they good enough to stay ahead of the market year after year, especially when fees and expenses are included?

The most recent evidence isn’t encouraging.

Over the last five years, not a single mutual fund has beaten the market regularly, using the definition that S&P Dow Jones Indices has employed for two decades.

The S&P Dow Jones team looked at all the 2,132 broad, actively managed domestic stock mutual funds that had been operating for at least 12 months as of June 2018.

The team selected 25 percent of the funds with the best performance over the 12 months through June 2018. Then the analysts asked how many of those funds remained in the top quarter for the four succeeding 12-month periods through June 2022.

The answer was none.

Not a single one of the initial 2,132 funds managed to achieve top-quartile performance for those five successive years.”

Think about that. With all the expertise, tools, research, etc., Indexed Funds (non-managed) beat all 2,132 actively managed funds.

Consider accounts where the local financial planner may take an Assets Under Management Fee, then a fee for the actual management of the funds, and what was the real cost to own a fund that was beaten by an S&P 500 Stock Fund (or other types of index funds)?

And Wall Street cannot understand why $300 billion will be put into annuities this year.

“This is a classic reason for relying mainly on index funds — essentially, accepting overall market returns, no better and no worse. Note that for the 20 years through June, the S&P 500 annually returned more than 9 percent, on average — which means your investment doubled in value every eight years. That’s roughly what an index fund would have done for you — and it’s better than the vast majority of actively managed funds were able to do.

On the other hand, given this year’s losses in both stocks and bonds, it’s also clear that investing in broad, diversified index funds is no panacea. These funds don’t protect you when the market falls.

That’s why cheap, broad index funds make sense as core investments for the long haul, even in a year like this one, when the markets have been falling.”

Okay, so that’s a lot to unpack. The author is recommending “cheap, broad index funds…as core investments for the long haul.”

We now know that strategy will beat managed portfolios and Mutual Funds. In fact, there is a great book that I recommend my clients read called, “The Coffee House Investor”, that discusses this very subject in greater detail.

One of my very first clients lived by this philosophy of investing and was able to accrue several million dollars while working as a high school teacher for a private school (no pension). But he was smart enough to understand the “Sequence of Returns Risk” once he retired and knew that he would need to fill the years that he experiences losses with guaranteed income from an annuity.

Intuitively he already knew this, but most do not. So, I made a video that explains how annuities improve portfolio outcomes, such as in his case.

Annuities Improve Portfolio Outcomes

What if you’re in a situation where you have plenty of income and just want to withdraw money as needed? If you have the bulk of your money in Non-Qualified Accounts (already taxed), I explain how to use the “ATLAS Annuity Flex Strategy” in this video. Many thanks to Bryan Anderson over at Annuity Straight Talk for teaching me this strategy to help serve my clients better!

Or, if you have plenty of income, but the bulk of your money is in Qualified Accounts (not taxed), then you will want to check out the “ATLAS RMD Rescue Plan.” I’ll show you how to have the best of both worlds when Uncle Sam starts forcing you to give him his cut.

Regardless of which ATLAS plan is right for you and your family, there is always a balance. I like to tell my clients we can “swing for the fences” once they have their income guaranteed and a portion of their money is protected from loss. You can chase the bigger gains with the other part of your money when you have the other part protected.

But if you’re new to the world of annuities, the best way to become educated is to watch my entire video series, “20% More Income in Retirement.” That is the absolute best way to get educated. Then go ahead and click the “Schedule a Call” button so we can have a short conversation to get all of your questions answered!

Happy Holidays,

Marty

Disclaimer: This article is for educational purposes only and is not to be considered as advice to buy or sell any security products. For information on securities investing, you should speak with a licensed securities advisor.