To say competition in the annuity world is fierce would be the understatement of the century. With approximately 200 companies, and each company offering 5-20 different types of annuities, there are well over 1,000 annuities to choose from. However, this particular product is the first one I’ve seen in a while that could change the entire future of the industry!

It’s called a FILA, or Fixed Indexed Link Annuity. In order to bring more customer satisfaction for the client who is looking for higher returns, but also wants the benefits of no fees and complete protection from losses, the FILA could be a great fit.

Prior to the FILA, a lot of investors were sold on a Registered Indexed Linked Annuity (RILA), or a Variable Annuity (VA). The appeal to these products was you get 100% of the gains, but you would also incur 100% of the losses. Not to mention outrageous fees. Which totally defeats the purpose of owning an annuity. Some of the RILA’s would give you a “buffer” on your losses of maybe 10%. Meaning, the first 10% of the losses were on them, but any after that came out of your pocket and could eat into your principle. Again, this totally defeats the purpose of an annuity.

What the FILA does is allows you to risk a portion of your gains. And they will even let you decide how much of the gains you are willing to risk according to the upside potential you are looking to attain. (If any of the following language does not make sense, please reach out to me and we’ll walk through it together.)

For example (at the time of this newsletter):

0% Floor (no loss of gains) would give you a 26% Par Rate or a 3.5% Cap

-2.5% Floor (willing to have a reduction of 2.5% of your gains) would give you a 37% Par Rate or a 5.5% Cap

-5% Floor would give you a 47% Par Rate or a 7.25% Cap

-10% Floor would give you a 65% Par Rate of an 11.5% Cap!!!

Considering the next highest Cap Rate, without other associated fees or spreads, is 6% for an annual point-to-point on the S&P 500, and the next highest participation rate is 40%, this annuity will smoke the competition IF you are okay with risking a portion of the gains.

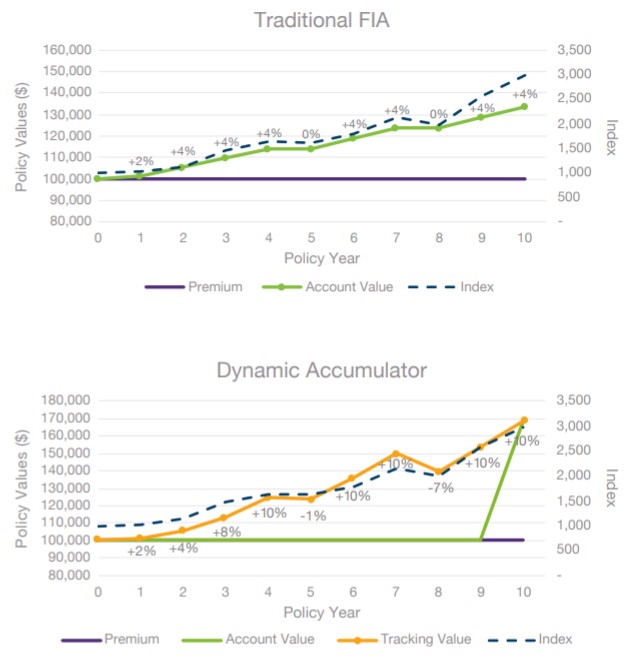

As you can see from the graph below, this particular indexing strategy would give you 120% more growth than your typical FIA with a 4% cap on the S&P 500. (Based on the 2010-2020 S&P 500)

As with almost all other FIA’s, the F&G FILA gives you the same benefits of principle protection, no fees, full surrender of principle and gains upon death, and a 10% Penalty-Free Withdrawal of principle and gains to be used strategically in an Atlas Annuity Retirement Strategy.

For more information to see if this annuity could be a good fit for you, give me a call at 636.926.6500 or click the “Schedule A Call” button to get on my calendar!

All the best,

Marty