The interesting thing about the annuity industry is it is always innovating. Just like with automobiles, annuities become more in tune with the times and what the marketplace calls for. This means they are becoming more hybrid, giving investors the best of both worlds that include huge growth potential and complete protection of your money.

Back in July of this year, I wrote about innovation to the Fixed Indexed Annuity world. It is called a Fixed Indexed Linked Annuity, or FILA. You can read that article here, What is a FILA?

That newsletter was specific to F&G who was the first company to release a product of this type. It was groundbreaking in the fact that it allowed you to have a 65% Participation Rate, or an 11.5% Cap on your earnings, which is much higher than any other strategy linked to the S&P 500 that is offered with standard Fixed Indexed Annuities. The annuity company can do this by letting you put some of the gains at risk, but still protecting 100% of your principal.

I’m still indifferent at this point because I’m a true believer in protecting 100% of your principal and your gains, especially when I’m designing a strategy for a lifetime income. But just like every other product in the marketplace, there is someone out there that can benefit, or they would not have designed it.

Here are some key points to the American Equity Flex 10 that make it different from the F&G Dynamic Accumulator:

- Up to a 20% Cap Rate on the S&P 500

- 5 Different Indexing Strategies

- F&G offers a 65% Participation Rate while American Equity only offers a Cap Rate, but the Cap Rate is much higher than F&G

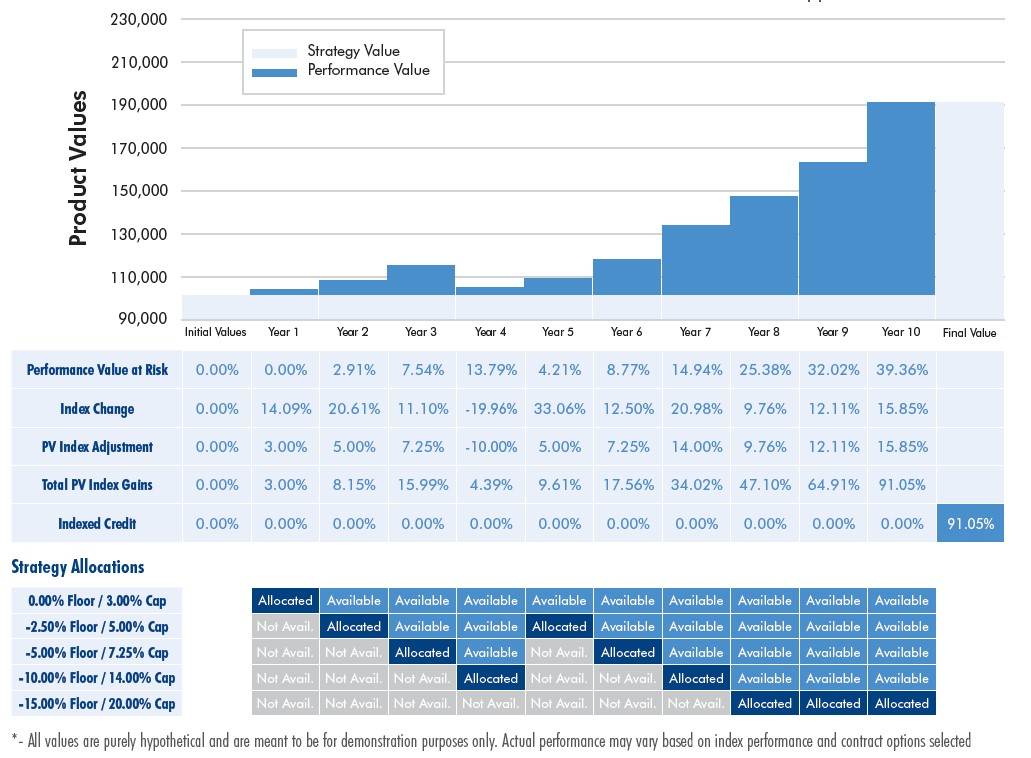

Here is what some of the gains would look like according to American Equity’s brochure:

I have no clue what years in the S&P 500 they are using.

What are some of the benefits of using a FILA?

- Much higher Cap Rates than an FIA with the S&P 500 (or Participation Rates with F&G)

- 100% Principal Protection

- 10% Penalty Withdrawal starting at the beginning of Year 2

- 100% Penalty-Free Surrender upon Death, Terminal Illness Diagnoses, or Long-Term Care Confinement

- Annual Reallocation of Funds to any of the 5 Indexing Strategies (American Equity only at the time of this posting)

- RMD friendly if you will be 72 years or older at any point during the 10-year agreement

- Zero fees

What are some of the negatives to using a FILA?

- Only offered as a 10-Year Product

- 10% Penalty-Free Withdrawal is limited to the Initial Premium/Principal, vs. a Traditional FIA where your gains would be available to withdrawal as well

- Potential gains could be lost, but your principal is always protected

- It takes time to build up enough gains to qualify for the 20% Cap

Who is this a good fit for?

I would say this is for the person who has a lump sum of money that does not need it for income and wants to benefit from bigger gains available with the increased Cap & Participation Rates, while still protecting 100% of their principal.

Again, this is a very interesting and important development in the annuity world. Do you think this would be a good fit for you and have additional questions? Well, call me at 636.926.6500, or click the “Schedule A Call” button and let’s get your questions answered!

Thank you and I hope everyone had a very Happy Thanksgiving!

All the best,

Marty