I talk with people every day that are just starting their retirement or near retirement. They are in the “Fragile Decade”, which is the 5 years before you retire, and the 5 years after you retire. Any significant losses in this ten-year period could dramatically alter the plans that you’ve been working towards for 30-40 years. Either by increasing the chances of running out of money completely or by greatly reducing the amount of money you can spend.

Most likely, if you have a pulse right now, you have lost money in the market. The first reaction for most, which is normal, is to stay put and wait to get back to your “high-water mark” to give yourself a sense of comfort.

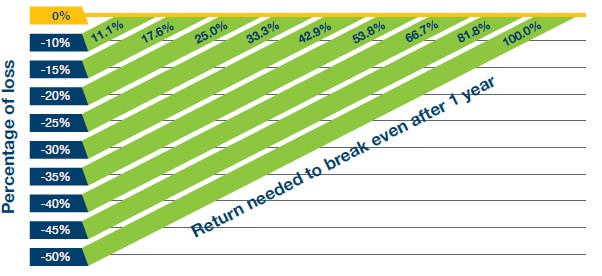

This could be a huge mistake. Have you ever asked yourself, “If I had $100,000 and I lost 20% in the market, how much will I have to gain to get back to $100,000?”

If the first thought in your head is, “20%”, unfortunately, you would be wrong. It’s more than 20%. And the bigger the losses, the bigger the gains necessary to get back to break even. And the bigger the gains needed, the longer it will take to get there.

Let’s look at the math:

$100,000 – 20% ($20,000) = $80,000

$80,000 + 20% ($16,000) = $96,000

Uh oh.

That’s a problem. So, how much of a percentage increase do I need to regain my losses?

In this scenario, it’s 25%. And the bigger the losses, the bigger the gains you need to recoup.

Take a look at this chart:

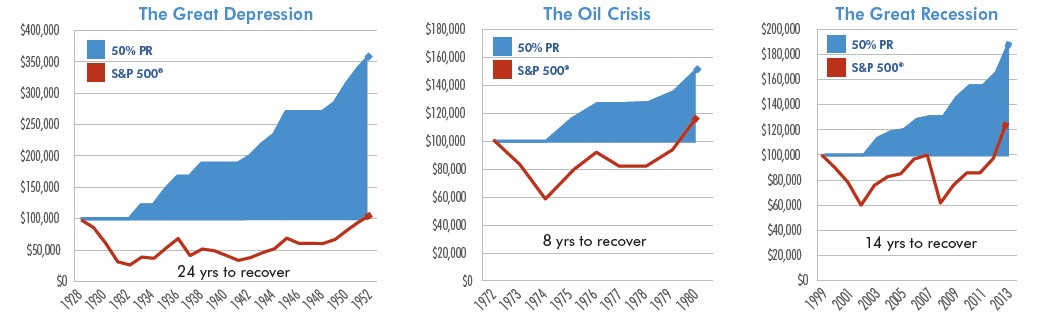

“Sure, but the market always comes back.” I’ve heard that a thousand times.

My response: “It sure does, but will it come back in time to save you from going broke?”

Look at this historical chart from 3 major bear markets and how long it took just to break even:

I mean, that is astounding. It took 14 years just to break even after the last recession!

The difference for my clients now, versus when they were still working, is they do not have another 10 or 20 years to keep contributing to their retirement. What they have today must last them for the rest of their lives.

I would like you to ask yourselves a question and take it as seriously as possible.

“Do I honestly believe that Wall Street, the Federal Reserve, International Corporations, or the Government has my best interest in mind?”

This whole system is rigged. It’s rigged against me, and it’s rigged against you.

Here’s another question I want you to ask yourself.

“Did my advisor recommend that I move any of my money out of the market before the downturn?”

If the answer is “no”, are you okay with that?

Last question. I promise.

“Will anyone ever care more about your money than you?”

It’s time for all of us to take back control of our money.

“But don’t you lose control of your money when it’s in an annuity?” Maybe in a sense with how much access you have to it, but with proper planning that’s not an issue.

However, when you lose control of your money in the market, not only did you lose access to it, but you flat out lost it. POOF! Gone. No recourse for you. No one to be held liable for the loss. It’s just gone!

Sure, you can sit around and hope that it comes back eventually, but what happens if you need it now? I personally rather pay a small penalty for accessing more than the terms I originally agreed to than have it flat out disappear. At least that part I can control.

I say all of that to say this – “keep educating yourselves.” Go to my video section on this website and learn as much as you can about protecting your money and start taking back control of your financial future.

All the best,

Marty