There are two things that are certain in life – death & taxes. One of those things we “kinda” have some control over based on the way we vote and where we choose to live.

How about the other certainty? No control whatsoever.

Being a Professional Firefighter/Paramedic, I see death on an almost daily basis when I’m on duty. All the way from pediatrics to people that have celebrated triple-digit birthdays. There is just no rhyme or reason to it.

I have transported people to the hospital in their 50’s who I would’ve guessed were in their 80’s, and I’ve transported people in their 90’s who I would’ve guessed were in their 60’s.

Some people will live long healthy lives, and some won’t. That we know for sure. What we don’t know is who those people will be.

This is where the importance of guaranteed lifetime income and protection comes into play. It’s a hedge against one of the biggest risks in retirement – longevity. And there are only a handful of things that can provide a guaranteed monthly income for life: Defined Benefit Pensions, Social Security, & Income Annuities. And the first two are getting sketchier by the day.

Now, there are a few exceptions to the rule. One is, that you have so much money saved for retirement and need such a low withdrawal rate (less than 3% of your investments), that an Income Annuity may not be the best solution for you. Maybe it would be a Multi-Year Guaranteed Annuity (MYGA) or a Fixed-Indexed Annuity (FIA) that would provide growth and protection from loss.

The other exception would be someone who has been diagnosed with an ailment that almost ensures an early passing. I just spoke with a gentleman this week who informed me that he has MS and knows that he won’t make it into 80’s, much less to age 100. So, these are important things to discuss with your advisor.

I will say about this gentleman because I really enjoyed speaking with him – I think he has lived more life already than most of us ever will. He spent his early years traveling around playing music while getting paid. Now that I’m in my 40’s and have a profession, a business, and a family, I truly admire those who spent their early years following their passion even if it meant being on the road with an uncertainty of the future. That takes guts!!!

So, would an Income Annuity be appropriate for him knowing that he has MS? Maybe. Maybe not. It would probably have to be some sort of spend-down strategy with a payout plan that still offers a lifetime income just in case.

Why “just in case?” Because my hope as medical treatments continue to advance that we’ll find effective solutions for cancer, Alzheimer’s, and MS. Who knows where we’ll be in 5 or 10 years? Regardless, he, and everyone that works with me, will have these important factors taken into consideration.

Although we do not know how long we live as an individual, the American Academy of Actuaries has a really good idea of how long we will live as a group. If you have never met an actuary, they are some of the smartest people on the planet. I refer to them as, “pediatric neurosurgeons that hate blood.”

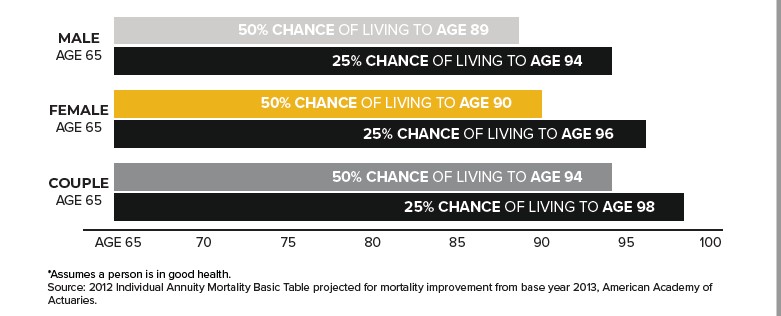

Take a look at this chart:

A healthy 65-year-old couple has a 50% chance that at least one of them, if not both, will live to age 94. Those are pretty good odds. How long does the average advisor plan on you living? 92.

I find that a great disservice to a population that is living longer, and hopefully, healthier lives.

Not to mention that there is a 25% chance that one person in that couple will live to 98! Again, we do not know who it will be, we just know it will be someone. And I personally do not want to see my clients gamble their money and be totally reliant on Social Security.

I forgot where I read this, but I do remember distinctly reading it because it was so shocking. It has been said the first person that will make it to their 150th birthday has already been born. 150! Think about that. That’s insane!

Not only will my annuities hedge against longevity, even if you live to 150, but using them the right way, you can enjoy more of your money. According to economists like Dr. Wade Phau, you should only start your retirement by using a withdrawal rate of 3%, or less. That means for every $100,000 you have saved for retirement on the day you walk away from your paycheck or your business, you can only take $3,000 per year. And that still does not guarantee that you will not run out of money before you run out of life. I’m sorry, but that is weak!

Even without putting any thought into a customized strategy, and if all we did was look at a straight Fixed Indexed Annuity with an Income Rider, that same 65-year-old couple could get a 5.56% payout rate (at the time of this writing) and still have some opportunity for growth in a market index if they were concerned about leaving some money to their beneficiaries.

That’s 85.33% more spendable income right out of the gate.

What if they were not concerned about leaving money behind, but still wanted the assurance that if they did not get all their money back in income, the remaining balance would be passed to their beneficiaries (aka Return of Premium)? Well, that same couple could get a 6.28% payout rate (at the time of this writing), or $6,276 for every $100,000.

That’s 109.2% more spendable income.

Please do not take this as a personal assault on intelligence, but we’re not splitting atoms here. This is simple math. But you must be the one to break free of the decades-long programming from the financial industry that has convinced you that you will get a 7% year-over-year return on your money if you just continue to risk it in the market and, of course, pay their management fees. If that was really the case, then why can you not take 7% of your money every year?

Because it doesn’t work that way. It never has, and it never will.

Okay, I’ll step off my soap box. Maybe what I just wrote above makes zero sense to you. If it does not, I will highly recommend that you take the time to watch my video series “20% More Income in Retirement” which can be found under our new “Videos” tab at the top of this page. I have broken up the Atlas Annuity Strategy into 5 short videos that you can watch and digest on your own timetable. Once you have had a chance to view them, the next step would be to book a short phone call by clicking the “Schedule A Call” button on the top right corner of the screen. That’s the best way to get your questions answered and verify everything that I talk about on the website.

I hope this newsletter finds everyone well during this time while summer is starting to wind down. And as always, I wish you all the best in your financial education!

Marty