Understanding how annuities grow in value (especially Fixed Indexed Annuities) is often where people get confused. That’s why one of my first podcast episodes had to cover this topic. My hope is that I can simplify it enough for you to quickly understand why this is such an important part of your retirement strategy.

Fundamentals of Fixed Indexed Annuities

Fixed Indexed Annuities offer two growth options: a fixed interest rate or tracking a stock market index. Importantly, your money is not directly invested in the stock market, offering protection against downturns.

The Role of Stock Market Indexes

A stock market index, like the well-known S&P 500, groups publicly traded companies, and their collective performance affects the index’s return. FIAs offer a variety of these indexes, allowing for tailored investment strategies.

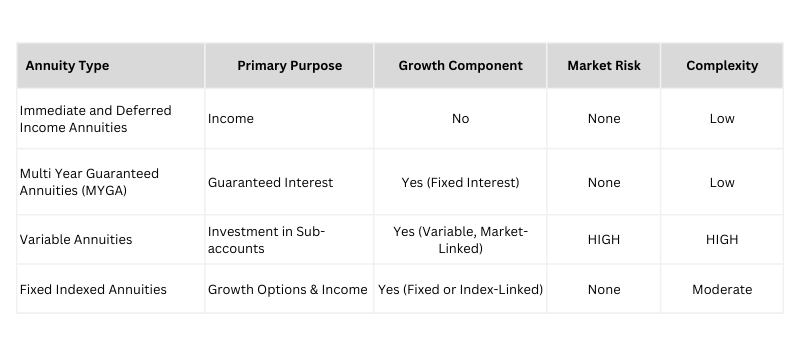

Here’s a quick table to represent the various types of annuities I talk about in the included podcast episode:

Understanding Crediting Strategies: The Drivers of Growth

The growth of your FIA is determined by crediting strategies, which dictate how your annuity’s value changes based on the performance of the index you’re tracking. There are three primary crediting methods:

- Spread: You earn interest above a predetermined spread rate. For instance, if the index goes up by 10% and your spread is 5%, you’ll earn the remaining 5%.

- Cap Rate: A ceiling limits your maximum return. For example, if the index increases by 10% but your cap rate is 5%, your growth is capped at 5%.

- Participation Rate: You receive a percentage of the index’s returns. For instance, if the index gains 10% and your participation rate is 50%, your FIA grows by 5%.

Myth Busting: Annuity Companies Don’t “Keep the Difference“

A common misconception surrounding FIAs is that annuity companies keep the difference between the index’s return and your crediting rate. This is 100 percent untrue. Annuity companies make their profit through their investment portfolio of investment-grade bonds. They do not benefit financially from keeping additional returns of your chosen index(s).

Crediting Terms: Selecting the Right Measurement of Time

Crediting terms, also known as crediting periods, determine the time frame over which the index’s performance is measured. Crediting terms are typically offered in one, two, three, five, or even six-year increments.

For example, if you choose a one-year point-to-point crediting term, the annuity company will take a snapshot of the index’s value on the day your policy is issued. One year later, they’ll take another snapshot to determine if the index has increased or decreased in value. Based on the beginning and then ending value, your account value will grow according to your chosen crediting method if the index has increased in value. Or you will receive a zero percent credit if the index has decreased in value while your principal value is protected from loss.

Optimizing Your FIA Growth

To maximize your FIA’s growth potential, consider these recommendations:

- Split your money across one-year and two-year point-to-points. This ensures you catch the index’s performance more frequently.

- Avoid caps whenever possible. Caps limit your potential returns and can hinder growth.

- Explore indexes with participation rates above 100%. These can provide significant growth opportunities and hopefully, more consistent returns, since these types of indexes are designed to be “volatility controlled.”

Remember, FIAs are long-term investments with the intention to protect your principal with terms from 1 or more years.

Key Takeaway: Protection and Growth in One

FIAs offer a unique blend of protection and growth potential. They shield your money from market downturns while providing opportunities to participate in market upswings. By understanding crediting strategies, crediting terms, and working with a professional annuity strategist, you can make informed decisions that align with your retirement goals and mitigate unnecessary risk and fees.