Misconceptions about discretionary liquidity in retirement funds is a topic that, while crucial, often goes unmentioned.

Today’s topic is a continuation of the last several weeks where we’ve been going through these retirement planning mistakes, with a special focus on one that is particularly interesting: the belief that you have liquidity in your retirement portfolio when you really don’t.

Many people fear that investing in annuities means all their money will be “locked up.” However, have you ever considered that even if you don’t have an annuity and you’re already retired, your retirement portfolio may essentially still be locked up?

Deep Dive: The Liquidity Illusion

Dr. Wade Pfau provides profound insight into this issue. He suggests, “In a sense, an investment portfolio is a liquid asset, but some of its liquidity may only be an illusion. Assets must be matched to liabilities.” He elaborates that while retirees are free to reallocate their assets, these are not truly liquid because they must be preserved to meet the spending goal.

“Assets cannot be double counted, and while a retiree could decide to use these assets for another purpose, doing so would jeopardize the ability to meet future spending needs.”

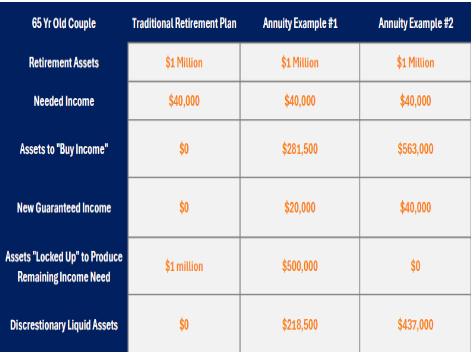

Here’s a quick example to illustrate these points.

This chart shows a 65-year-old couple, with a million dollars in their portfolio. Under a traditional retirement plan, they adhere to a 4 percent withdrawal rule, which is considered acceptable. Yet, they have zero liquidity because that million must remain invested to continuously produce $40,000 a year in income. If they were to withdraw an additional amount for an unexpected expense or a luxury purchase, they would need to readjust their entire retirement plan.

However, changing strategies to include an annuity changes the scenario. By funding an annuity with part of their portfolio to cover part of their income needs, they can free up a significant portion of their assets, enhancing their liquidity.

This adjustment allows for more flexibility and security, demonstrating that the strategic use of annuities can provide better financial outcomes than the apparent liquidity of a traditional investment portfolio.

Discretionary Liquidity in Retirement Case Study

Now, let’s take a look at a real-life case study I just worked on.

We have a couple who are 77 and 70 years old. So they have a little bit of an age gap there, which we had to overcome.

They have about $2.7 million in assets. When it’s all said and done after taxes, they need about $96,000 per year in addition to their social security.

We took just under $800,000 to fund an annuity with a guaranteed income of $5,000 per month or $60,000 per year. This is an important point: We didn’t fill the entire income gap with the annuity. There’s a sweet spot in there for everybody. But what that did was it left about $36,000 as an income gap. To get them to the $96,000 that they need, if they were sticking with that 4 percent withdrawal rule, which they’d probably be okay because they’re in their 70s, $36,000 is 4 percent of $900,000. So that’s how much would have to stay invested in the portfolio.

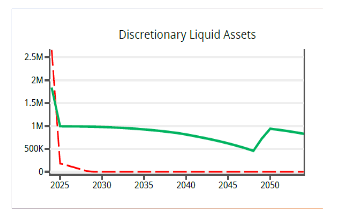

But because they should stay within a certain limit of the withdrawal rates, as we talked about in Episode 21, that only left them with about $200,000 in liquidity. As you can see in the graph above, the red dotted line is doing what are currently doing, and the green line is implementing the ATLAS Annuity Strategy with the income annuity. So they only have about $200,000 in real liquidity, and then that went away pretty quickly because of inflation increases. So now that we have a large chunk, about two-thirds of the income needs covered, that freed up a million dollars in discretionary liquidity!

See these case studies in more detail in the podcast episode…

In this episode of the ATLAS Annuity Podcast, I go much deeper into explaining the details of these examples and case studies, so if you’d like to get more information on understanding discretionary liquidity in retirement, definitely give the video above a watch.

Podcast Episode 22: Analyzing Discretionary Liquidity in Retirement

Download Episode 22: Analyzing Discretionary Liquidity in Retirement on Apple Podcast