ATLAS ANNUITY RATE REPORT

In this month’s ATLAS Annuity Rate Report, we’ll look at the highest MYGA and FIA rates. Plus, I will list the highest returns of the indexes that have increased participation rates with an optional fee. When assessing returns, I always consider the renewal rate history of the companies that I recommend. That means it does no good if a company offers a 100% participation rate if they have a track record of decreasing that rate during your next indexing period. There are plenty of annuity companies that have a solid track record of renewal rates. For the most up-to-date returns or information on 5-year and 7-year FIA’s please click the “Schedule A Call” button or reach me directly at 636.926.6500.

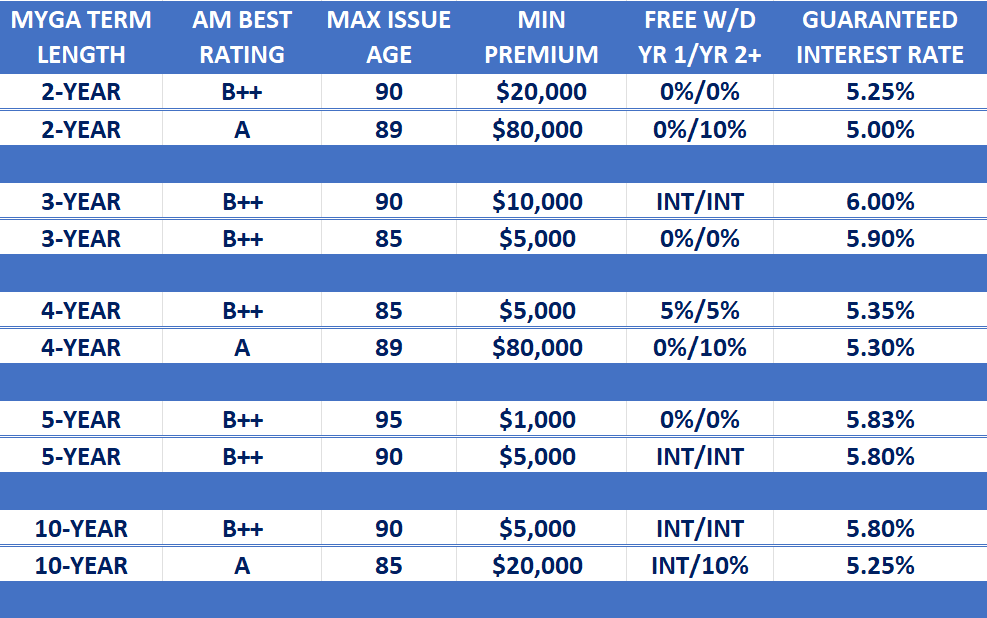

Here are the latest annuity returns in the marketplace:

MYGA ANNUITY RATE REPORT

Disclaimer: These rates are based on what is available in the State of MO. Certain rates may not be available in your state of residence. There may be rates that are slightly higher, but due to the customer service track record of those carriers, Atlas Financial Strategies has chosen not to work with them. To find out what is available in your state please reach out to Atlas Financial Strategies, Inc. directly.

How To Get The Most Out of Annuities:

When we design your ATLAS Annuity Strategy, we will discuss how to use crediting methods to give you the best chance of getting a return every single year with the highest participation rates available.

In addition to these phenomenal rates that have absolutely zero risk of the principal associated with them; they leave you access to 10% of your money starting at the beginning of Year 2 (certain annuities will give you access in Year 1). For a complete strategy on how to effectively use one of these products with my ATLAS Annuity Strategy, instead of bonds or other products that risk your money, all while potentially saving yourself tens of thousands of dollars in management fees, click the link to see a complete overview. Or schedule a time for a short conversation by clicking the “SCHEDULE A CALL” button!

Disclosure:This is a solicitation for insurance based on guaranteed tax-deferred fixed annuity rates. Rates are subject to change. State of residence, age, premium, and financial suitability may determine availability. Early termination surrender charges may apply. Guarantees are backed up by the claims-paying ability of insurance carriers and are not FDIC insured. Certain restrictions and exclusions may apply, which can be found in the contract disclosures. This document is not a legal contract. Martin M. Becker and/or Atlas Financial Strategies, Inc., is an independent insurance agent/agency and does not offer tax or legal advice. This material is for informational or educational purposes only and is not a recommendation to buy, sell, hold, or roll over any asset. It does not consider the specific financial circumstances, investment objectives, risk tolerance, or needs of any specific person. You should work with Martin M. Becker/Atlas Financial Strategies, Inc. to discuss your specific situation.

All the best,

Marty