This has been an unprecedented year in the stock market. I have spoken with hundreds of people that have reached out to me and told me their stories about the losses they have sustained in their portfolios. My heart goes out to them because it is such a scary thing to experience when you are depending on that money to sustain you for the rest of your life.

Some of them have made the decision to protect what they still have, and others continue to be “Hopium” addicts. They hope the market will go back up. They hope they will regain their losses. And they hope that they won’t lose any more than what they already have.

Unfortunately, just like with other addicts I have dealt with in my career as a firefighter/paramedic, addicts are very difficult to get through when confronting them about their destructive behavior. At the end of the day, it’s their life. And in this case, it’s their money. All I can do is try to be a supportive voice of reason and offer a legitimate solution.

I would like to share a story of a couple who is retired and has lost approximately 20% of their money this year alone. They were scared because their advisor told them “Not to lock in their losses.”

I asked in return, “has he ever advised you to lock in your gains?” Of course not. I personally have never heard an advisor recommend a client sell an equity when they were at an all-time high, because “it could go higher.” And I have never heard an advisor recommend selling in a declining market because “you’re locking in a loss.”

“Don’t worry. The market always comes back.” Maybe, eventually. But when is the real question?

Did you know that it took almost 14 years for the S&P to reach the same levels it had in 2000? Most of my clients cannot wait 14 months, much less 14 years.

“Hopefully, it will come back soon.” You are a “hopium” addict if you are still thinking that way.

So, when are you supposed to sell? Well, in the world of traditional advising, you’re not. “Buy & hold” is always the recommendation. And that may work when you are still working and contributing to an investment account. But it doesn’t work that well when you are retired and withdrawing money.

Is it time for you to walk out of the Wall Street Casino and start taking the guarantees?

As always, that’s totally up to you. I cannot advise you to buy or sell equities, so this is not a recommendation to do anything. But what if you could recoup your losses on a guaranteed basis?

Let’s get back to the couple that I mentioned earlier that lost roughly 20% of their investments.

They had roughly $500,000 in the market and now they have approximately $410,000. How did we make them whole again?

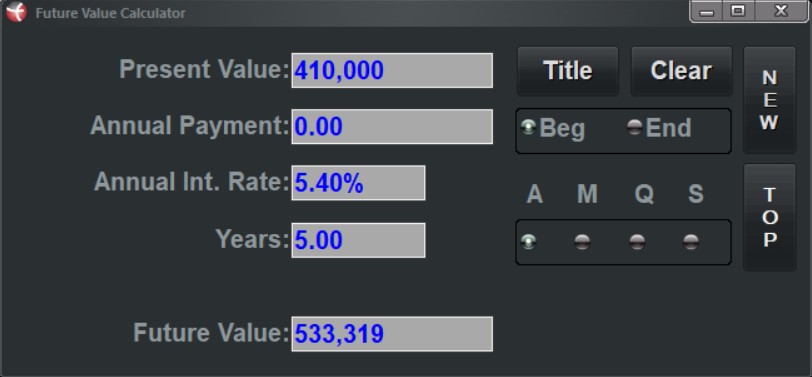

This strategy is as simple as it gets. We took the $410,000 and put it into a 5-year MYGA (Multi-Year Guaranteed Annuity), with a A-rated company at 5.4%.

Boom, a guaranteed $533,319 at the end of the term. No guesswork. No magic. Just guarantees.

“But”, I can hear you saying, “what if they need that money?” Well, they asked the same question.

“Do you think you will need to pull more than $41,000 in any given year?”

“No.”

And there it is. People assume that all their money will be “locked up” without considering the 10% penalty-free withdrawal and how much that actually is for them personally.

I say all of that to say this, get off of the “hopium”. You don’t have to live that way anymore with constant wondering what the market will do next. And I’m not saying you should never have money in the market. But figure out what you need to survive and what you don’t want to lose, and protect it with your life!

So, that is my final rant for the year 2022. I “hope” this newsletter finds you well and that you have a very Happy New Year! I look forward to working with you in 2023. As always, don’t hesitate to reach out with questions about your personal situation by clicking the “Schedule a Call” button in the top right corner of this screen.

All the best,

Marty