“How Much Can You Safely Withdrawal from Your Retirement Savings?”

That question is not only one of the most hotly debated by economists, but it is a vital question that can have serious implications on your future if you get it wrong.

Two important points that determine what this magical number is:

- How much will the market return over the next 30 years?

- How long will you live?

No one knows what the market will do tomorrow, much less over the next 30 years. And no one knows how long they will live. The smartest minds in the world have been asking this question since Defined Benefit pensions started disappearing.

At best, the greatest minds in the world, are guessing.

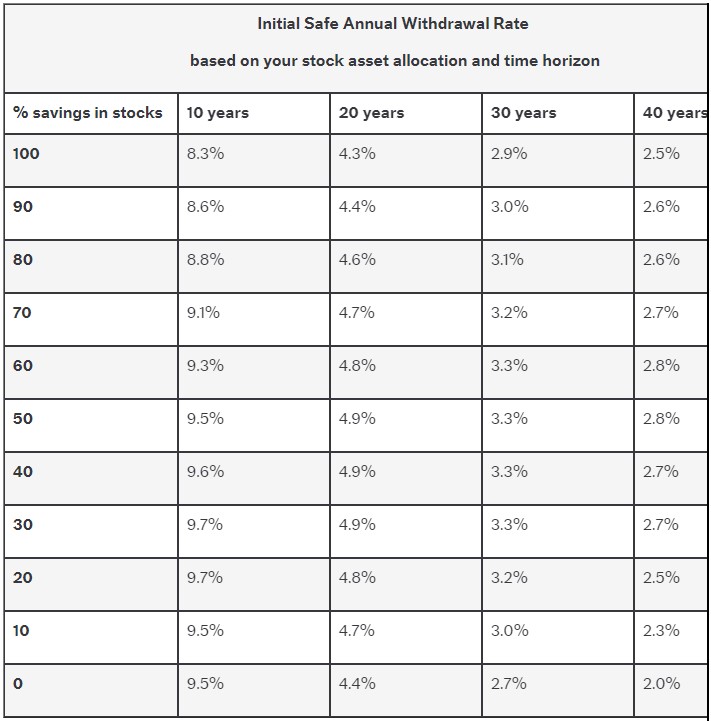

The research company, Morningstar, is one of the most respected publications in the world of finance and has written numerous articles on this subject. The AARP recently published an article with a very simplified spreadsheet based on the research from Morningstar:

The table shows how much money you can withdraw from your retirement funds in the first year of retirement. The vertical axis on the left shows the percentage of your holdings that are in stocks. The horizontal axis on top is the number of years you expect to be in retirement. After the first year, you can increase your withdrawal every year by the amount of inflation.

For example, suppose you had a $100,000 nest egg with half the portfolio in stocks. You expect to live another 30 years in retirement. You could withdraw 3.3 percent of this money, or $3,300, in that first year. This amount could increase each year with inflation. Someone (or a couple) with a 10-year life expectancy could spend 9.5 percent of their nest egg in their first year, while a young retiree with a 40-year life expectancy could spend only about 2.8 percent of the portfolio.

Note how the safe spend rate is higher when the portfolio has a moderate percentage of stocks. That’s because having so much in bonds is risky in that it’s unlikely to beat inflation after taxes, though having so much in stocks is also very risky as the stock market may not quickly recover after the next plunge. (**From article link above**)

I personally always recommend to my clients that they plan to age 100. So, the younger they are, the longer they need their money to last. Of course, there are other factors that come into play, such as inflation and the fact that most people spend more money in the early years of retirement. But to keep this simple, we’ll look at a static withdrawal in year one based on a 30-year time frame.

Based on the above spreadsheet, the most someone could take for a 30-year timeframe is 3.3%. If a 62-year-old couple had $500,000 for retirement, the most they could withdraw is $16,500 per year, before taxes. And that is still not guaranteed to last them the entire 30-year time frame.

But wait, it gets worse. That 3.3% withdrawal rate does not account for management fees. When you calculate a 1% fee (fund fee, fund manager, or both), that drops the sustainable withdrawal rate by another 0.4%.

Now, you’re already paltry withdrawal of $3,300 for every $100,000 that you have saved for retirement, is reduced to $2,900…before taxes! And don’t forget, this is not even guaranteed to prevent you from running out of money. This is just the best guess by some really smart people.

“What are the options?”, you may ask yourself. Well, you only have a few:

- You can withdraw more money and increase the risk of running out of money

- You can withdraw less money and never fully enjoy what you have saved

- You can transfer a portion of your money to a Fixed Indexed Annuity with an Income Rider

Option #3 is going to be your best option, in my opinion, for several reasons:

- You’re guaranteed to never run out of income, even if you run out of money

- Knowing that your income is guaranteed, you will have a ticket to spend and enjoy your money with peace of mind

- You could get a much higher payout rate with the annuity than with a standard withdrawal method using a managed portfolio

Let’s look at an example:

Using the same couple as listed above – 62 years old and $500,000 in retirement savings — with the above research we know that the most they could withdraw would be $14,500 per year, after accounting for 1% in management fees (most likely they are paying closer to 1.5% – 2%).

If this couple took $250,000 of their retirement money and transferred, not “bought”, but transferred that money to an annuity, what would that look like for their income?

As of this writing, one of the top-paying Fixed Indexed Annuities with an Income Rider will guarantee a 62-year-old couple a 4.64% payout rate, or $4,644 for every $100,000 transferred to that particular company, if they turn the income on immediately (it gets bigger the longer they wait). And since the guaranteed Income Rider is already a part of that calculation, the expense is internalized and accounted for.

If this couple transferred $250,000 to the annuity company, that would give them an annual income of $11,610 per year…every year for the rest of their lives…guaranteed…with no market risk.

If they decided to leave the remaining money in the managed portfolio, that would allow them to withdraw an additional $7,250 per year at the recommended 2.9% withdrawal rate.

In total using this plan, this couple’s income increased from$14,500 per year to $18,860 per year.

That comes out to be 30.07% more spendable income!

And that was literally the most straightforward and laziest example I could think of. There are all kinds of strategies that I could look at to possibly get them even more. For example, we could look at possible laddering techniques, or coming up with a plan to spend more out of their managed assets early on when they’re in their “go-go” phase of retirement, with the understanding that if the market does not perform their income could be reduced in their “slow-go” phase of retirement (normally in their 80’s for most couples)

This is so simple! Why don’t more people do this? Well, the biggest issue is perception. That’s a complex issue in itself and I have taken the time to write an entire article just on that subject, which you can find here: 6 Reasons People Do Not Use Annuities

Do you want to spend the rest of your life worried if you are spending too much out of your retirement accounts? Is it a ridiculous idea to spend 30 minutes on the phone if I can show you numbers like these?

Then let’s talk. Let’s get a plan together. It’s so simple. It’s so easy. And believe it or not, it’s actually kind of fun when you can take that stress out of your life! For a down-to-earth discussion about how I could get you more spendable income in your retirement, and protect your money from a market decline, click the “Schedule A Call” button, or call me directly at 636.926.6500.

All the best,

Marty