Today we’re going to talk about a subject that is fiercely debated: annuities vs stocks – which is better?

A Disclaimer Before We Dive In

I’m going to start with the disclaimer that this is not a recommendation to buy or sell any type of securities product. You should always check with your licensed security advisor before making any type of decision. So now that I’ve kept myself out of trouble with that disclaimer, let’s jump into this!

Understanding the Purpose of Your Money

Back to the original question, “Annuities vs Stocks. Which is better?” My answer to that question comes in the form of another question which is, “Better for what?”.

Asking which is better is like asking which type of car is better, a Corvette or an F 350 dually truck. They’re two totally different types of vehicles. There really is no way to compare them.

For instance, a Corvette is flashy and fast and fun, and you’re going to look really good pulling up to the restaurant or the golf club. But, what if you need to tow a boat?

Can the Corvette do that? What if it snows 12 inches? Can the Corvette get you around town? What if you need to move a couch? Can you fit a couch in the back of a Corvette? Of course not, because it’s not designed to do any one of those things, and that’s totally okay. Everything that’s been designed in our modern society has been designed for a specific purpose. That’s why somebody made it.

Annuities vs Stocks: Different Tools for Different Goals

The question that you should be asking is what is the purpose of my money? Because until you answer that question, you cannot decipher which is going to be better for your personal situation.

If the purpose of your money is to get as much growth potential as possible, then you should definitely consider stocks, because that’s what they’re designed to do. But that’s also where you’re going to experience the most volatility, meaning that’s where you’re going to experience the most amount of losses.

Because the losses are going to happen at some point. It’s not a matter of if you are going to lose money in the stock market. It’s a matter of when are you going to lose money in the stock market.

Misconceptions and Wall Street Math

I’ll give you an example of what I mean because if you call a guy like me and you tell me that you’re getting 12 percent in your stocks, I’m going to have to slam you…nicely.

I just talked to a guy last week, and he told me that he earned 20 percent in his stocks this year. My immediate response was, “Hmm, no, you didn’t.” And then of course there was this long silence on the other end of the line where you could almost hear him thinking. When he eventually responded, he said, “What do you mean? It says it right here on my statement.”

So this is where I had to give him a little lesson in what I call Wall Street Math, which is determining the difference between average returns and actual returns. I’m going to do an entire episode on this at some point in the future but for now, I just want to give you the basics of what I mean, because a lot of people actually don’t understand this.

And to me, it seems pretty straightforward because I look at my balances, not at the returns on the statement. Because I actually own stocks. I’m not anti-stock. However, I have had basically the same amount of money in one of my investment accounts for the past three years, and mind you, there have been tens of thousands of dollars that have been added to this account and my returns as a percentage look amazing, but the account balance hasn’t changed that much.

So why did he think he gained 20 percent this past year in his stocks?

Well, number one, because the statement said he earned 20% and he believed it. Technically, if you go back to December of 2022, the S&P 500 was sitting approximately at 3,800. Fast forward one year to December of 2023, and it’s approximately 4,700. That’s almost a 24% gain!

But…there’s always a ‘but’, if you go back to December of 2021, the S&P 500 was at an all-time high hovering around 4,800. It was way up, and then it lost a thousand points, and then it rebounded this year by about 900 points to get to almost the same level.

The Reality of Market Volatility and Returns

Now, what was his real return over the past couple of years? What is his actual return?

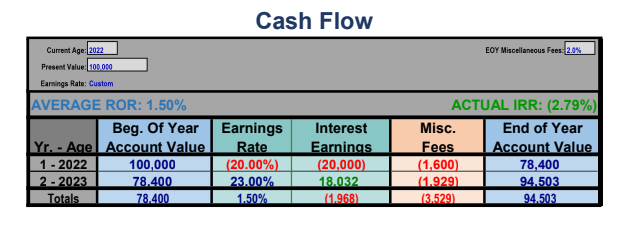

If he had $100,000 at the end of 2021, and then he lost 20%, and then he gained 23% back, what is his actual return going to be? Because most people just using quick math in their head will think, “Well, if I lost 20 percent and then I gained 23%, I should at least break even.”

But that’s not how this math works.

He actually had a negative return over the past two years. His actual return was negative 1%. But in reality, it’s worse than that because when you factor in 2% management fees, (and most people are paying 2 percent in fees, whether they know it or not between the manager fee, the portfolio fee, and the internal fund fees) with 2% management fees, his actual return was negative 2. 8% over the past two years.

So he went backward even though his statement said he gained 20%.

Comparing Returns: Annuities vs Stocks

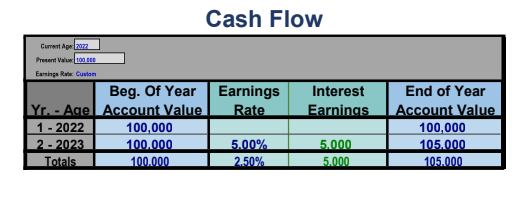

Now, what if he had an annuity that offered him a 5% cap on the S&P 500? What would his actual return be in that scenario?

He would have gotten a 0% return from December of 2021 to December of 2022 because the market was down that year. So he didn’t lose any money, but he got zero growth that year.

And this year, since the market rebounded, he would have gotten that 5% interest credit with the cap, and because there are no fees in this type of growth annuity, it would have made his two-year average almost 2.5%. And his actual balance in the stock portfolio in this scenario would have been $94,000, but if he had the annuity, his balance would be $105, 000.

He would have been over $10,000 ahead using the annuity, even though he technically got a 20% gain in one year with the stocks.

So what’s my point in telling you all this? Because I can do these comparisons all day long, but based on the timeframes that we’re looking at, I can make stocks look amazing, then select a different period of time and make annuities look amazing.

Why It’s Not an All-or-Nothing Decision

My point is these are two totally different types of assets. That’s what’s important in this discussion.

If we’re talking about growth, it all depends on the timing, which is why it’s probably a good idea to have both. This doesn’t have to be an all-or-nothing deal. You don’t have to have all your money in stocks, and you don’t have to have all your money in annuities.

Diversification is a good thing, but it has to be diversification across asset classes. Diversification doesn’t count if you have your money spread across a bunch of different stocks or different mutual funds. It’s still all in the same type of asset class which is a risk of loss.

It could be a good idea to have both stocks and an annuity because you’re never going to get hurt in a growth annuity by losing your money in a market downturn.

Understanding Wall Street Math and Actual Returns

However, if you’re going to look at your statements that show you made 20% in your stocks and only 5% in your annuity, you’re going to get upset unless you understand how this ‘Wall Street Math’ really works. I don’t want you to sit around and be fooled into thinking that you’re doing better than you really are.

When you’re working and you have a steady source of income and you’re investing for retirement, it’s not a huge deal. You can withstand the ups and downs of the market because you’re not relying on those stocks to provide your income.

Think of it this way – when you’re working, it’s like having two vehicles. You have the Corvette and the F350 pickup truck.

The stocks, or the Corvette in this scenario, is not your only mode of transportation and it can go super fast. But it’s also going to require a lot of maintenance and it’s going to break down quite a bit because it’s designed for hard and fast driving, which puts a lot of stress on the vehicle itself.

But if you also have your job or your business, the Ford truck in this analogy, then it’s not that big a deal that the other vehicle breaks down or needs maintenance because your income is what is providing you with the living expenses.

When the Corvette breaks down, or your stocks lose money, no one likes it, but it’s sustainable because it’s not your only means of transportation.

The Importance of Reliable Financial Vehicles in RetirementHowever, when your income stops at your retirement and you walk away from your job or your business, the reliability of your financial vehicle becomes vital!

The performance, or lack of performance, of that vehicle can have dire consequences for your retirement.

Chasing market performance during retirement is insanity because the only thing that matters in retirement is guaranteed cash flow. But this is what people have been told to do their entire adult lives. So they just buy stocks and that’s what they do. They don’t know anything different.

And again, in the accumulation phase, it’s not that big a deal because you have the other vehicle. You have the income from your job or your business. But that is only during the accumulation phase.

When you’re retired, you’re in the decumulation phase, which is a totally different animal. The problem starts when you’re losing money in a stock portfolio and you’re taking money out to live on. At that point, you’re stealing the seed that has always planted the next harvest during you’re working years.

This is exactly how people run out of money. It’s a total ‘gotcha’ situation that the financial industry has put retirees in.

If you try to use a majority of stocks for your retirement income, you can take less income and lower your chances of running out of money, but you may also die with way more money than you wanted, never really having a chance to enjoy what you worked all those years for.

Or you can spend more money upfront with the stocks, but you also increase your chances of running out of money at the end of your life and end up surviving on your social security.

Neither one of those is an ideal scenario.

So, we have to go back to the question that you need to ask yourself, which is, “What is the purpose of my money???”

For the vast majority of people, It’s going to be to provide income in retirement.

Now, if you’re a person who has millions upon millions of dollars and only needs to pull 3% of your assets out to live on in retirement, then an annuity may not be the right vehicle for you because you can withstand the ups and downs of the stock market, or the breakdown of the vehicle to stick with the original analogy.

However, there is a strategy that can enhance your overall outcome by having a safe bucket of money to dip from which is called the flex strategy that I learned from a good friend of mine, Bryan Anderson over at Annuity Straight Talk.

So, if you’re the person who has tons and tons of money and lots of streams of income and you don’t need to touch your money other than to pull some lump sums as needed, then an annuity could just act as a safe bucket of money to dip from when your stocks are in the negative.

But, if you’re the person who has to pull 4% or more of your total assets per year, in addition to your Social Security and any pensions that you may have, then you’ve got a problem. Because you’ll need an income vehicle that is reliable enough to withstand any storm during your retirement.

“Nothing can provide income better than an income annuity.”

Please keep in mind, that this statement is not the opinion of Marty Becker. That is the opinion of economists who research this stuff every day for a living. So that part is indisputable. One thing all these economists agree on is that having an income annuity is an essential part of your retirement planning.

The only argument that is still up for debate between them is which type of annuity you should implement, and when you should implement it.

Income Annuities Vs Stocks With Dividend Payments

Now you could be sitting there saying to yourself, “Well, I don’t need an income annuity because I have a dividend-paying stock.” To which I would respond, “That’s great!” Those are probably the best ones to own, but can those dividends go down? Can they change? Can they completely disappear? The answer is, yes.

You cannot rely on that for guaranteed income.

I’m not saying there are no other financial vehicles available that can produce an income in retirement for you. I’m just saying the reliability is unmatched to an income annuity.

The other choices available cannot beat the reliability of an income annuity. Not stocks, not bonds, not ETFs, not mutual funds, not CDs, not crypto, not real estate or precious metals.

None of those things can match the certainty and reliability of providing income in your retirement for the rest of your life better than an income annuity.

The reason is the income annuity takes away several retirement risks. The top two are Longevity Risk and the Sequence of Returns Risk.

In the podcast episode, I go much deeper into the risks and workings of how many advisors, including the big ones you’ve probably heard of (and may have worked with in the past) have put billions of dollars into negative marketing to convince people not to even consider annuities. Plus, I include several case studies showing how the annuities vs stock question can be answered in many different scenarios.

So, make sure you watch or listen to the episode, and as always, if you have questions, click the “Schedule a Call” button and we’ll look at your situation together to make sure you reach your retirement goals.

Marty,

I always enjoy reading your words of wisdom for understanding of how to invest.

Something that bothers me is with this changing world of economic, political and environmental conditions, what can we invest in that offers optimum security?

Thanks,

Gene

Hi Gene,

I’m glad you are finding the information helpful and thank you for your kind words! To answer your question, the ultimate safety comes with annuities. Annuity/Insurance companies have survived every war, pandemic, political administration, and economic crisis that has ever been thrown at them. The question is, which type of annuity is right for your situation?

Beyond that, although I cannot provide specific investment advice, some areas to investigate may be precious metals to protect from currency devaluation. Think of gold and silver as “freezing your fruit.” And another area that you may consider is companies that produces consumables. No matter how bad it gets, Americans will always buy toothpaste, trash bags, and toilet paper. Again, that is not a recommendation to invest in either of those, but some food for thought.

I hope this finds you well and thank you again for your question!

All the best,

Marty