Have you ever wondered what people who actually own annuities say about them? If you’re curious, you’re not alone. A recent survey of over 1,000 people who own annuities uncovered 5 key index annuity benefits that make the biggest difference in retirement. Let’s explore the top five reasons why people say owning an index annuity is a positive choice for their financial future.

1. Longer Lives, More Peace of Mind

People are living longer than ever, and that’s a good thing! But longer lives also mean we need money that lasts. The top reasons people choose guaranteed lifetime income with index annuities are for peace of mind:

-

- Savings that don’t run out – to ensure they have income, no matter how long they live.

-

- Essential expenses covered – so they don’t worry about basic living costs.

-

- Extra protection – for unexpected expenses as they age.

When your money is designed to last, you can enjoy life more fully. And for many, that’s the greatest benefit of an index annuity.

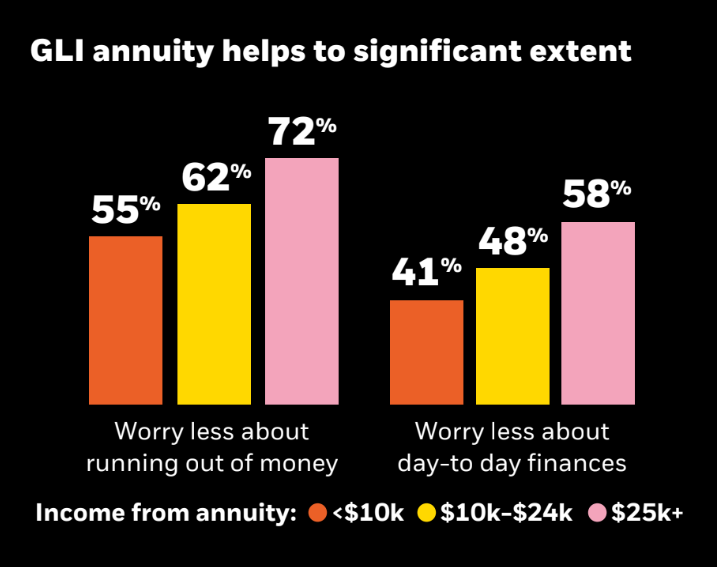

2. Guaranteed Income, Less Financial Stress

The number one financial worry for retirees is running out of money. With an index annuity, there’s less to worry about:

-

- 97% of annuity owners say it helps them feel more secure about not outliving their money.

-

- 93% say they stress less about covering daily expenses.

Having a steady, guaranteed income means you can cover your living expenses and enjoy peace of mind. When you know where your income is coming from, retirement feels a whole lot better.

3. Market Protection, More Security

In an unpredictable economy, it’s normal to worry about how markets will perform. But here’s the good news: an index annuity offers “market protection” that keeps your funds safe from downturns.

-

- 88% of annuity owners say their annuities help ease concerns about market drops.

With index annuities, there’s a sense of “sleep insurance” because you don’t have to lose sleep over stock market swings. Here’s how it breaks down:

| Feature | Benefit |

| Market protection | Protects against downturns |

| Guaranteed income option | Consistent retirement income |

| Peace of mind | Less worry about investments |

When your essential expenses are covered, you have more freedom to take risks with other investments.

4. Safeguards Against Vulnerability in Retirement

Unfortunately, older Americans lose billions each year to fraud and exploitation. With an index annuity, you have built-in protections:

-

- 84% of annuity owners say they feel less vulnerable to financial fraud or bad investment decisions.

-

- 92% report it’s easier to manage their money as they get older.

Aging can make financial decisions tougher. Index annuities offer a layer of safety that helps retirees feel secure against the threat of fraud, poor investments, or simply forgetting to manage funds.

5. Steady Income Leads to More Confident Spending

A regular, reliable income in retirement gives people the freedom to spend confidently:

-

- 53% of survey respondents feel comfortable spending on things they want or need.

-

- 61% say they’re very confident they can withdraw money sustainably.

With an index annuity, retirees know they’ll receive income each month, regardless of market changes or the economy. When income is secure, it’s easier to live the retirement you’ve worked for without fear of running out of money.

| Spending Confidence | Index Annuity Owners (%) |

| Comfortable spending | 53% |

| Confident withdrawals | 61% |

Why Major Financial Institutions Are Recommending Index Annuities

Fixed Indexed Annuities are becoming a go-to option even for big financial institutions. Companies like BlackRock and Fidelity are taking a closer look at guaranteed income because traditional diversified portfolios aren’t always enough. More people are asking for retirement plans that resemble a pension, and annuities fit that need.

For those who want financial security that lasts, index annuities offer the ideal blend of steady income and peace of mind.

Get a Second Opinion to Find the Best Annuity Option

If your financial advisor recommends an annuity, it’s a good idea to get a second opinion from a non-captive advisor. Non-captive advisors aren’t limited to a few products and can help you find the best deal among many options.

When selecting an index annuity, think about:

-

- Your retirement goals – How much guaranteed income do you need?

-

- Company options – Choose from a variety of providers to find the right fit.

-

- Advisor type – Non-captive advisors may offer more options.

Taking a little extra time to review your choices almost always results in a better fit for your financial plan.

Podcast Episode 48: The Top 5 Index Annuity Benefits

Download Podcast Episode 48: The Top 5 Index Annuity Benefits on Apple Podcast